Mexico needs to review its trade relationship with China because it isn’t “reciprocal,” Finance Minister Rogelio Ramírez de la O said Saturday after pointing out that Mexico’s imports from China far exceed its exports to the East Asian nation.

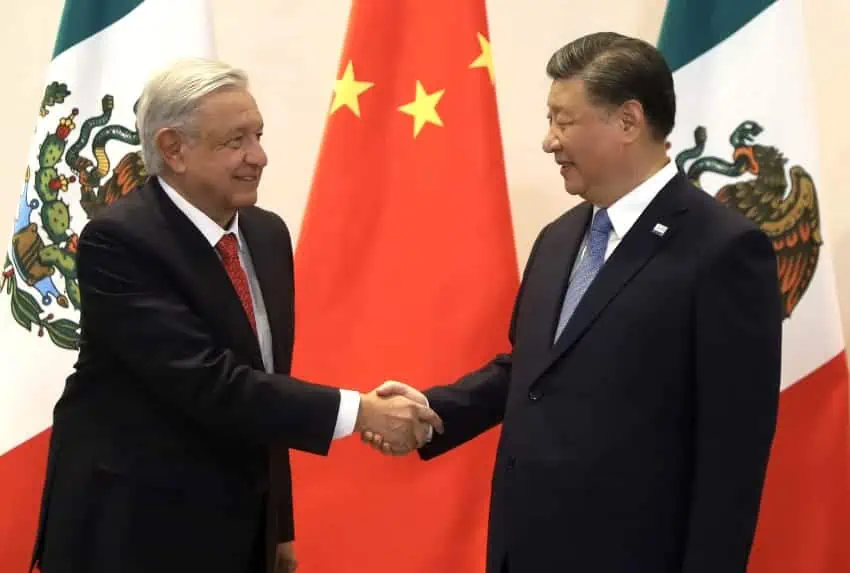

At an event in San Luis Potosí alongside current and future officials including President Andrés Manuel López Obrador and President-elect Claudia Sheinbaum, Ramírez said that Mexico is too dependent on China for basic goods.

“In 2021, President López Obrador … asked me to develop what he called Plan Mexico. This is a plan to create awareness that Mexico, like North America [as a whole], needs to produce more than it consumes, that we’re depending too much on basic products from China for our homes,” he said.

“… Mexico has to carry out its own review because … we buy US $119 billion [worth of products] per year from China and we sell $11 billion [worth of goods] to China. China sells to us but doesn’t buy from us and that’s not reciprocal trade,” said Ramírez, who will stay on as finance minister after Sheinbaum is sworn in as president on Oct. 1.

The finance minister said that Mexico has “great opportunities to produce more” and by doing so will “maintain our industry, our jobs and our salaries.”

Previous advantages of manufacturing in China, such as low labor costs, have “disappeared,” Ramírez said, adding that shipping costs from the Asian nation to North America “have exploded upward.”

A growing trade deficit with China

Data from China’s General Administration of Customs (GAC) shows that Mexico’s trade deficit with the East Asian economic powerhouse has more than doubled between 2018 and 2023.

The data — which differs from the figures cited by Ramírez — shows that Mexico imported goods from China worth a record high $81.5 billion last year. Mexico exported products to China worth $18.8 billion in 2023, leaving it with a record high trade deficit of $62.7 billion.

Mexico’s trade deficit with China was just under $30.1 billion in 2018, according to the GAC.

China’s exports to Mexico — among which are raw materials, capital goods, consumer products and cars — increased 85% between 2018 and 2023, and 152% between 2014 and 2023.

In contrast, Mexico’s exports to China only increased by 33% over the past five years and 68% over the last ten.

Ramírez said Saturday that China’s share of the global market for exports has increased to 14% from 3.8% in 2001, the year it became a member of the World Trade Organization.

“This increase was to a large extent at the cost of North America,” he said.

“The North American participation [in the global export market] … declined from 19% in 2000 to 13% in 2022,” Ramírez said, referring to Mexican, U.S. and Canadian exports.

The three North American countries are very dependent on Chinese exports, he said, although Mexico has now overtaken China as the largest exporter to the United States.

“The United States depends on China for 16.5% of its total imports, Canada depends [on China] for 13.5% and Mexico depends on China for 19.6% of its total imports,” Ramírez said.

“This is a situation that has led to a feeling [that there is a need] to further protect our industries, and this sentiment has grown both in the United States and in Mexico,” he said.

Ramírez also noted that China’s share of global GDP has increased significantly over the past two decades while North America’s share has decreased.

“It’s logical that both Americans and Mexicans are demanding our fair share of this global demand [for exports], and that’s why we have Plan Mexico,” he said.

Will Mexico increase tariffs on Chinese imports?

Ramírez didn’t make any specific announcement about a plan to increase tariffs on Chinese goods, but he did say that officials were “busy doing our job to bring industry back.”

One way to help Mexican industry would be to make their products more competitive by imposing higher tariffs on Chinese imports.

In an interview with Mexico News Daily in June, former Mexican ambassador to China Jorge Guajardo said that imposing higher tariffs on Chinese imports to protect Mexican industry was a pressing and important task for the incoming government.

In April, the current government implemented new tariffs that impacted more than 500 Chinese products, but Guajardo told MND that Mexico needs to do more to “help Mexican industry withstand this tsunami of Chinese imports” — and quickly.

The former ambassador said that “ideally,” Mexico, the United States and Canada would all “mirror each other’s tariffs” on Chinese products.

In May, the United States announced that its tariff rate on Chinese electric vehicles would increase to 100% from 25%.

A change of investment policy on the horizon for Mexico?

Mexico is currently welcoming significant amounts of Chinese investment, and more Chinese money is expected to come into the country as companies such as Lingong Machinery Group and electric vehicle manufacturer BYD act on their announced plans.

President López Obrador said in March that Chinese investment in Mexico “will continue.”

However, while speaking about Mexico’s relationship with China on Saturday, Ramírez said that the government is “considering” changing its investment policy. Without providing specific details, he suggested that Mexico could seek to prevent or limit Chinese investment in some sectors.

Reuters reported in April that pressure from United States authorities has led the Mexican government to refuse to offer incentives to Chinese electric vehicle manufacturers planning to invest in Mexico.

In late 2023, Mexico and the United States agreed to cooperate on foreign investment screening as a measure to better protect the national security of both countries.

The plan appeared to be motivated to a large degree by a desire to stop problematic Chinese investment in Mexico, although United States Secretary of the Treasury Janet Yellen said at the time that her investment screening talks with Ramírez were “not just China-focused.”

A major reason why Mexico attracts Chinese companies is that it allows them to ship their products to the United States tariff-free. Mexico has consequently been described as a “backdoor” to the U.S.

In May, United States Trade Representative Katherine Tai said “stay tuned” when asked whether the U.S. could impose protective measures against products made in Mexico by Chinese companies, such as electric vehicles.

Sheinbaum — who will become Mexico’s first female president when she takes office on Oct. 1 — said earlier this month that her governments’ aim will not just be to attract investment, but to ensure that money flowing into Mexico leads to development across the country and generates “well-being” for all Mexican people.

With reports from Reforma, El Economista, El Financiero and El Universal