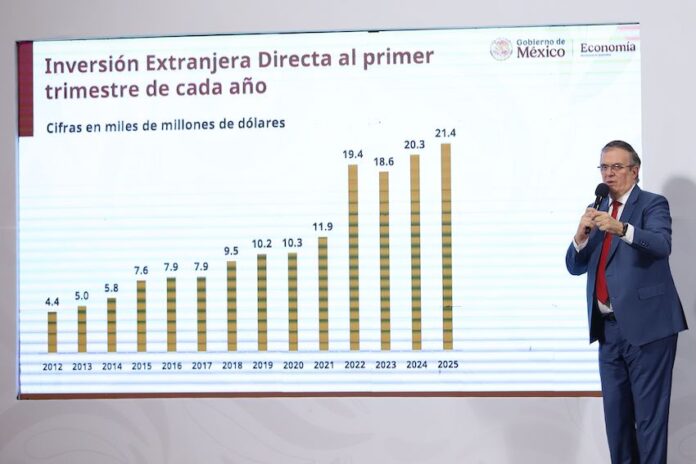

Foreign direct investment (FDI) in Mexico hit a new record high of US $21.4 billion in the first quarter of 2025, Economy Minister Marcelo Ebrard reported Thursday.

“It’s the highest [first quarter total] we’ve ever had,” Ebrard said at President Claudia Sheinbaum’s morning press conference.

“…It’s very good news because it was a complicated quarter on the international stage” he said, referring primarily to the protectionist policies implemented by United States President Donald Trump since he began his second term on Jan. 20.

The $21.4 billion first quarter FDI total represents an increase of 5.4% compared to the $20.3 billion Mexico received in foreign investment in the first three months of 2024. Last year’s first quarter figure was a record high at the time.

A graph presented by Ebrard on Thursday showed that FDI in Mexico increased in the first quarter of every year since 2012, with the exception of 2017, when the Q1 total was equal to that of the previous year.

Compared to the first quarter of 2012, when FDI totaled $4.4 billion, foreign investment in Mexico was 386% higher in the first three months of 2025.

Ebrard highlighted that the highest first quarter FDI total during the “neoliberal stage in Mexico” — a term used by ruling party politicians to describe the period between 1982 and 2018 — was in 2018, when $9.5 billion flowed into the country.

Unilever announces US $1.5B investment to complete Nuevo León factory and expand Mexico operations

“In the fourth transformation we reach this year the all-time high of $21.4 billion in foreign direct investment,” he said, using the self-anointed nickname of the political movement founded by former president Andrés Manuel López Obrador and now led by Sheinbaum.

“I think that it’s very good news,” Ebrard said.

The economy minister didn’t provide a breakdown of the FDI Mexico received in the first quarter of 2025.

In 2024, almost 80% of the US $36.87 billion FDI total came from reinvestment of profits by companies with an existing presence in Mexico. New investment accounted for just 8.6% of the 2024 total, with the remainder of the money — 13.5% of the total — being loans and payments between companies of the same corporate group. Almost half of all FDI in Mexico last year came from the United States.

On Thursday, Ebrard only said that the increase in FDI in the first quarter of the year meant that Mexico received “more reinvestment and more capital arriving to our country through all avenues.”

The low level of new FDI last year — whose $3.17 billion total represented a decline of more than 30% compared to 2023 — raised additional concerns that Mexico was not capitalizing on what has been described as a “once-in-a-lifetime” opportunity to attract foreign investment amid the nearshoring trend.

The Sheinbaum administration, which took office last October, launched an ambitious economic initiative called Plan México in January, which, among other objectives, aims to spur foreign investment in Mexico and reduce reliance on imports, especially from Asia.

Government’s plan to build ‘well-being hubs’ moves ahead

In April, Sheinbaum announced 18 “programs and actions” related to Plan México. One of the supplementary actions she outlined was to begin by the middle of May the tendering processes for the construction of 15 new “well-being hubs” (polos de bienestar): industrial zones or corridors across the country, each of which will specialize in different economic sectors.

On Thursday, Ebrard said that 14 of those “well-being” and “development” hubs, to be located across northern, central and southeastern Mexico, have been approved by state governments. He also said that tendering processes to find companies to build them have begun.

The planned industrial corridors cover “many states,” the economy minister said.

“Quintana Roo, Michoacán, Veracruz, Tlaxcala, Tamaulipas, Sinaloa, Puebla, Hidalgo. You will say, does Hidalgo have two? Yes it does,” Ebrard said before noting that the new industrial corridors will also run through the states of Guanajuato, México state, Durango, Chihuahua and Campeche.

He presented a map that showed that the government is evaluating, or will evaluate, the establishment of an additional 16 industrial corridors. Already partially operating is the Isthmus of Tehuantepec development hub, where cargo trains are now transporting goods across the narrow strip of land between Salina Cruz, Oaxaca, on the Pacific coast and Coatzacoalcos, Veracruz, on the Gulf coast.

Ebrard noted that the government will offer tax incentives to companies that invest in the new development hubs. He said the government expects that Mexican and foreign companies that operate in a wide variety of sectors will invest in the industrial zones.

Those sectors, he said, include aerospace, automotive, agro-industry, pharmaceuticals, medical devices, electronics, semiconductors, chemicals, textiles, clean energy, plastic, metal and logistics.

Ebrard stressed that the construction of the industrial zones “has to do with the development of strategic economic sectors for our country” and will ensure that there is “development in all of Mexico and not … just some regions.”

“…. It has to do with the increase in national content that has been proposed in Plan México,” he added.

“And above all, the most important thing is that there is shared prosperity, that if we have [economic] growth and investment it is translated into well-being. That’s why the [development] hubs are linked to the concept of well-being,” Ebrard said.

By Mexico News Daily chief staff writer Peter Davies (peter.davies@mexiconewsdaily.com)