Mexico was one of the world’s top 10 exporters in 2023, rising four places in the rankings to ninth, the El Economista newspaper reported.

Citing data from the World Trade Organization (WTO), Mexico’s national statistics agency INEGI and the Federal Customs Service of Russia, El Economista reported Tuesday that Mexico surpassed Russia, Canada, Hong Kong and Belgium to become the ninth largest exporter in the world last year.

Never before has Mexico ranked as high as ninth in the global export rankings, and only once before, in 2019, has it found a place among the top 10.

The value of Mexico’s exports increased 2.6% last year to reach a record high of US $593.01 billion, according to preliminary data published by INEGI in January. The increase was sufficient to take Mexico past Russia, Canada, Hong Kong and Belgium, all of which recorded year-over-year declines in the value of their exports in 2023, El Economista said.

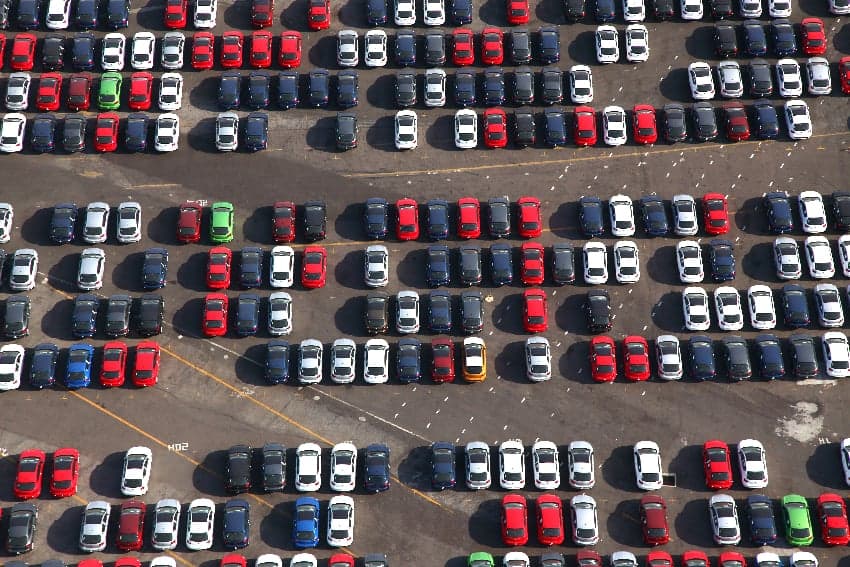

Over 80% of Mexico’s non-oil export revenue last year came from products shipped to the United States, while manufactured goods — including cars, auto parts, computers and machinery — generated almost 90% of all export income. Mexico was the top exporter to the United States last year, and the largest trade partner of the world’s largest economy.

Taking into account trade to all countries, China was easily the world’s largest exporter last year, shipping goods worth US $3.4 trillion to its commercial partners. The United States ($2 trillion) and Germany ($1.7 trillion) ranked second and third, respectively.

The same three countries occupied the top three positions in 2022, according to the WTO.

After entering the top 10 in 2019, Mexico slid one position in the rankings during three consecutive years, dropping to 11th in 2020, 12th in 2021 and 13th in 2022.

The country’s rise to ninth last year is related to the growth of the nearshoring phenomenon in Mexico, according to Israel Morales, an official with the manufacturing export association index.

“In 2023, we started to see the tangible effect of the relocation [of companies] or the growth of production lines in some plants that were already [in Mexico],” he told El Economista.

Mexico’s exports are expected to continue to grow in coming years as foreign companies that have recently made investment announcements open factories here and begin shipping their products to the United States and other markets around the world. Those companies include United States electric vehicle manufacturer Tesla and its main global competitor, BYD of China.

With reports from El Economista