Mexico’s central bank has once again decided to keep its benchmark interest rate at a record high of 11.25% as inflation remains a concern.

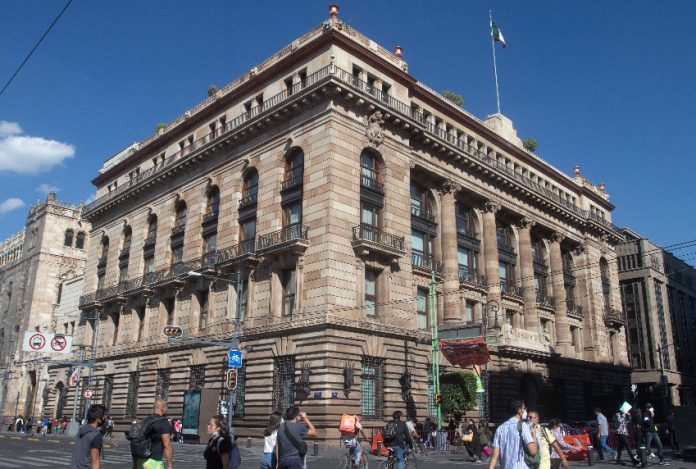

The Bank of Mexico (Banxico) announced that its five-member governing board unanimously decided to maintain the target for the overnight interbank interest rate at 11.25%.

The key rate was raised to that level in March and kept there following monetary policy meetings in May and June.

Banxico’s latest decision came after the national statistics agency (INEGI) reported Wednesday that annual headline inflation was 4.79% in July, down from 5.06% in June.

Consumer prices have now declined during six consecutive months, but the central bank said in a statement that annual headline inflation and core inflation – 6.64% in July – are “still high.”

It also said that “the inflationary outlook is still very complex, … complicated and uncertain throughout the entire forecast horizon, with upward risks.”

“Thus, in order to achieve an orderly and sustained convergence of headline inflation to the 3% target, [the board] considers that it will be necessary to maintain the reference rate at its current level for an extended period,” Banxico said.

The bank said the same thing in May when it ended a monetary policy tightening cycle that lasted almost two years.

Central banks in Brazil, Chile, Costa Rica and Uruguay have all cut interest rates in recent weeks after aggressive hiking cycles, but analysts cited by the Reuters news agency say that a reduction in Mexico’s benchmark rate is unlikely until late 2023.

“When [cuts] do arrive, they will be more gradual than most currently anticipate,” said Jason Tuvey, deputy chief emerging markets economist at Capital Economics.

At 4.79%, annual headline inflation is still almost two percentage points above Banxico’s target, and the bank – which officially tolerates a 2-4% inflation range – is forecasting that it won’t go below 4% until the second quarter of 2024.

The Bank of Mexico anticipates that the annual headline rate will fall to 4.6% in the final quarter of this year and reach 4.1% in Q1 of 2024. It predicts a 3.7% rate in the second quarter of next year, 3.4% in Q3 and 3.1% in the final quarter of 2024.

Analysts cite Banxico’s high interest rate and the significant difference between that rate and that of the United States Federal Reserve (currently 5.25-5.5%) as one factor that has caused the Mexican peso to appreciate against the greenback this year.

One US dollar was trading below 17 pesos on Thursday morning, but subsequently strengthened to close at 17.04 pesos, according to the Bank of Mexico.

With reports from Reuters