The Mexican peso depreciated to over 20 to the US dollar on Thursday morning, weighed down by the controversial judicial reform proposal that was approved by the lower house of Congress on Wednesday.

Compared to its closing position on Wednesday, the peso fell more than 1% to reach 20.15 to the greenback early Thursday.

It subsequently recouped some of its losses and was trading at 19.99 to the dollar at 10 a.m. Mexico City time.

It was the first time since October 2022 that the peso broke the 20-to-the-dollar barrier.

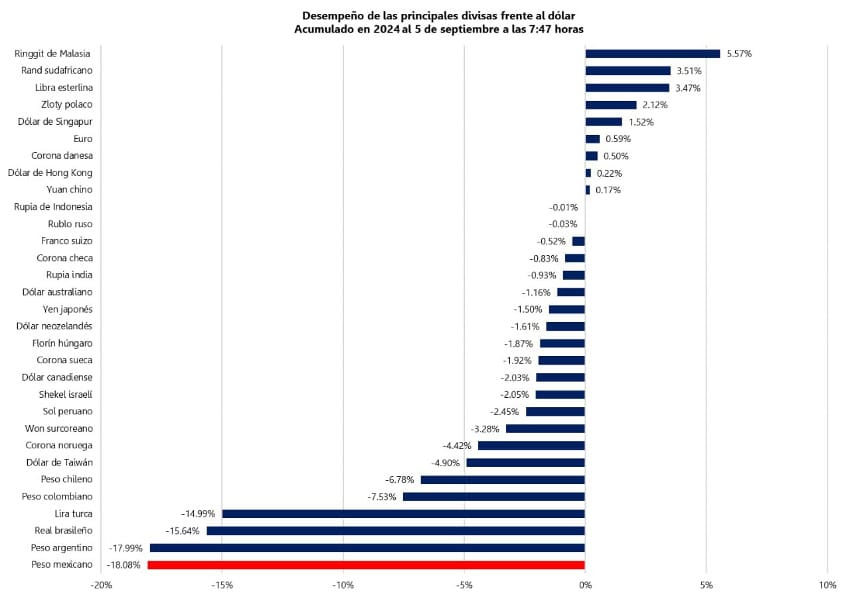

Since reaching a near nine-year high of 16.30 to the greenback in April, the peso has depreciated more than 18%.

Much of the decline has occurred after Claudia Sheinbaum and the ruling Morena party won comprehensive victories in the June 2 presidential and congressional elections, putting Morena lawmakers in a strong position to approve a raft of constitutional reform proposals that President Andrés Manuel López Obrador sent to Congress in February.

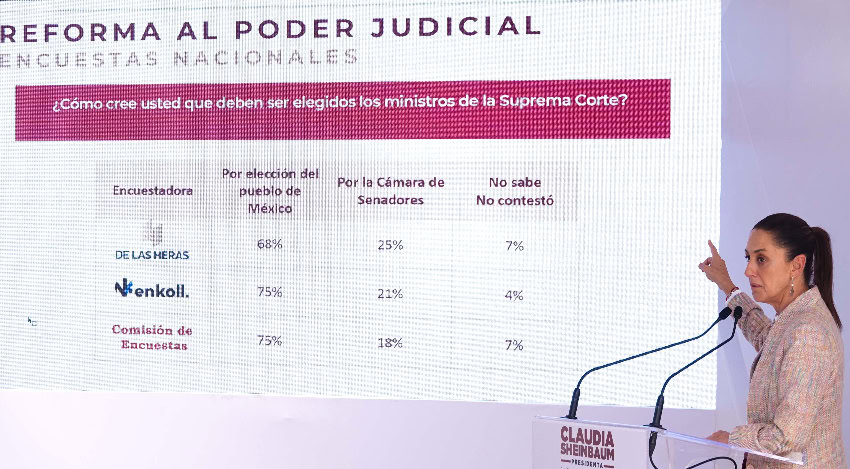

Investors have been especially spooked by the plan to allow Mexican citizens to directly elect Supreme Court justices and other judges. That proposal is now one step closer to reality after lawmakers in the Chamber of Deputies approved it on Wednesday morning.

The Senate — in which Morena and its allies are just one vote short of a supermajority — is set to consider the bill next week.

López Obrador and President-elect Sheinbaum have defended the reform as the peso lost ground over the past two months, asserting that investors have nothing to worry about and that the reform will strengthen — not weaken — Mexico’s justice system and democracy.

Many critics of the bill — including United States Ambassador to Mexico Ken Salazar — have other ideas.

Foreign exchange news website FX Street reported Thursday that “the peso is being sold because investors are fretting about the Mexican parliament passing a controversial bill of reforms that critics say will compromise the independence of the judiciary, undermine democracy and damage international trade and foreign investment.”

“… From a financial perspective, the reforms run the risk of leading to a decline in foreign investment. This, in turn, would reduce demand for the peso, leading to a further depreciation of the currency,” FX Street said.

Financial news website Market Watch reported Thursday that investors have “dumped carry trades” involving the peso “amid concerns about political upheaval” in Mexico, and after an interest rate cut in Mexico last month.

The peso “has been buffeted by the prospect of passage of Mexico’s judicial reform…which has overtaken monetary policies and U.S. politics as a source of consternation in recent weeks,” said Thierry Wizman, a foreign exchange strategist at the investment bank Macquarie.

“It is likely to remain a source of worry throughout September,” he added.

Gabriela Siller, director of economic analysis at Banco Base, said on X that it is possible that the peso will trade at 20.50 to the dollar in September due to “greater risk aversion about Mexico and lower attractiveness for carry trades.”

She also posted a graph to X that showed that the peso has depreciated more against the US dollar this year than any other major currency.

The peso had been one of the world’s best performing currencies, supported by the significant difference between the Bank of Mexico’s official interest rate and that of the United States Federal Reserve.

Mexico’s central bank cut its benchmark rate to 10.75% last month, the second reduction this year after one in March. The Fed has maintained its federal funds rate at 5.25%-5.5% since July 2023.

Beyond the judicial reform, other factors that could affect the peso in the coming months are monetary policy in Mexico and the United States, the U.S. presidential election, economic growth rates and global geopolitical events.

With reports from El Financiero, El Universal, FX Street and Market Watch