As fears of a recession in the United States upended markets around the world on Monday, President-elect Claudia Sheinbaum declared that Mexico has a “strong economy with healthy finances.”

At a press conference after a meeting with governors of four states and officials from two others, Sheinbaum also said that her team is preparing for all possible economic scenarios.

“We’re not getting ahead of ourselves. We’re going to wait for the impact of what happened. The elections in the United States are also coming in November. We can’t say … [with certainty] that a recession is coming. We are prepared and we are preparing for every scenario,” she said.

Sheinbaum said it is a “good thing” that the Mexican economy is highly integrated with that of the United States, but stressed that the “internal market is today much stronger” as a result of the current government’s investment in infrastructure projects and spending on welfare and social programs, as well as private investment and wage increases.

She also highlighted that Mexico’s external debt has declined during the presidency of Andrés Manuel López Obrador.

“In these six years the economy of Mexico has been strengthened. Our adversaries will never accept it. They will always say that the neoliberal model was better than Mexican humanism. It’s not true,” Sheinbaum said.

“… The economy of Mexico is a solid, strong economy with healthy finances,” she said.

Speaking a day after the Mexican peso plummeted to above 20 to the US dollar, Sheinbaum acknowledged that “what happens in other countries clearly impacts Mexico financially.”

However, she asserted that the situation “would be very different” – i.e. worse – “if the Mexican economy was weak, or there wasn’t employment, or the internal market hadn’t been strengthened.”

“The advantages that Mexico has today is strength in its economy and strength also in investment,” Sheinbaum said, highlighting that investment projects are already been carried out, and more are in the pipeline.

She asserted that public and private investment will continue to support high levels of employment during her six-year term in government, which will commence Oct. 1 after she is sworn in as Mexico’s first female president.

Sheinbaum is committed to the development of additional passenger train projects, and has pledged to invest more than US $13 billion in a renewables-focused energy plan while maintaining support for the debt-ridden state oil company Pemex.

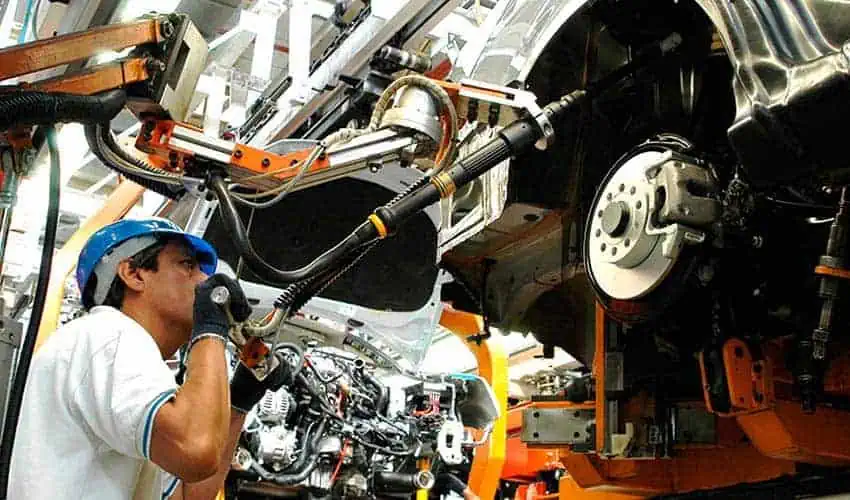

She also has a plan to create 10 new industrial corridors to attract foreign investment to all 32 of Mexico’s states, and has asserted that the nearshoring trend will help drive significant economic growth during the 2024-30 period of government.

Do Sheinbaum’s remarks stack up?

Are the president-elect’s assertions that the Mexican economy is “strong” and public finances are “healthy” supported by economic data. Let’s take a look.

Economic growth

The Mexican economy grew 3.2% in annual terms in 2023, according to national statistics agency INEGI.

Mexico’s economic expansion last year exceeded growth levels in the United States, Canada, Spain, France, Germany, the United Kingdom, Japan and Brazil. However, it lagged the growth recorded in China, India and Russia.

The Mexican economy has slowed in 2024. Annual growth in the second quarter of the year was just 1.1%, according to preliminary data from INEGI, while there was a 1.5% year-over-year expansion in the first six months of 2024.

The International Monetary Fund is currently forecasting that Mexico will record 2.2% economic growth in 2024.

Employment

INEGI reported last Friday that Mexico’s unemployment rate increased to 2.8% in June, up from 2.6% in April and May.

Despite the increase, Mexico’s unemployment rate remains significantly lower than those of the United States (4.3% in July) and Canada (6.4% in June).

One weakness in the Mexican labor market is that a majority of workers – 53.8% of the labor force in June – work in the vast informal economy and thus don’t have access to benefits such as paid vacations and health care at hospitals and clinics operated by the Mexican Social Security Institute.

Public debt

Deputy Finance Minister Gabriel Yorio González said last week that Mexico’s public debt will be equivalent to 48.6% of GDP at the end of the term of the current government.

Mexico has significantly lower debt that many other OECD countries including Japan, the United States, France and Canada.

Yorio said that Mexico’s public debt level is “sustainable” thanks to the government’s responsible financial management.

He also reported that Mexico’s external debt has declined from 5.1 trillion pesos when the government took office in 2018 to 4.1 trillion pesos (US $211.6 billion) today.

Inflation

Inflation remains a significant concern in Mexico two years after reaching an annual rate of 8.7% in August 2022, the highest level in more than two decades. The annual headline rate in the first half of July was 5.61%, up from 4.98% across June.

Mexico currently has one of the highest inflation rates among OECD countries. Among the 38 member countries, only Colombia, Iceland and Turkey had higher rates in June, the OECD reported Monday.

Other need-to-know economic data for Mexico

- The USD:MXN exchange rate was 19.39 at 11:30 a.m. Mexico City time, according to Bloomberg.

- The Bank of Mexico’s key interest rate is currently set at 11%. The bank’s board will hold a monetary policy meeting this Thursday.

- A record high of US $6.21 billion in remittances flowed into Mexico in June, according to the Bank of Mexico.

- In the first six months of 2024, private companies announced plans for more than US $45 billion in investment in Mexico, according to the federal Economy Ministry.

With reports from El Universal, El Financiero and Bloomberg Línea