Steel-related issues are not weighing on Mexico’s trade relationships with the world’s two largest economies, President Andrés Manuel López Obrador said Monday.

Speaking at his morning press conference, López Obrador said that Mexico has “very good” trade relationships with both China and the United States, although the federal government recently imposed tariffs on different Chinese steel products and the U.S. is concerned about a “surge” in steel exports from Mexico.

Earlier this month, the Economy Ministry (SE) imposed 31% provisional compensatory tariffs on steel nails from China. That move came after the SE placed 3-12% tariffs on steel balls from China at the start of March. The imposition of the trade barriers came after Mexico concluded separate anti-dumping investigations.

Meanwhile, two United States senators introduced legislation this month that aims to reinstate a 25% U.S. tariff on Mexican steel amid concerns about an increase in exports from Mexico.

That move came after United States Trade Representative Katherine Tai met with Mexican Economy Minister Raquel Buenrostro and “stressed the urgent need for Mexico to take immediate and meaningful steps to address the ongoing surge of Mexican steel and aluminum exports to the United States and the lack of transparency regarding Mexico’s steel and aluminum imports from third countries.”

Buenrostro subsequently said that Mexico is not receiving exports from China only to ship them on to the United States. She said late last month that Mexico would impose retaliatory tariffs on United States steel if the U.S. was to enact such a measure first.

On Monday morning, a reporter asked López Obrador about “trade policy with China” and the “steel dispute” as well as Donald Trump’s plan to impose a 100% tariff on cars made in Mexico by Chinese companies if he wins the U.S. presidential election in November and returns to the White House.

The president said that the SE is looking at the issues before declaring that Mexico doesn’t want to get involved in any kind of “war, not even a trade one.”

The government, he said, is seeking to maintain Mexico’s good trade relationships with the United States and Canada — the country’s two USMCA partners — and China.

Chinese investment in Mexico “will continue,” López Obrador said when a reporter questioned whether that would be the case.

There is no dispute with China, he stressed, explaining that there had not been any “protest” from the East Asian economic powerhouse on the steel issue.

“The trade relations with the United States” — Mexico’s largest trade partner — “and with China, are very good,” López Obrador said.

He went on to thank the government of China for what he said was the punctual supply of home appliances purchased in that country for victims of Hurricane Otis in Acapulco.

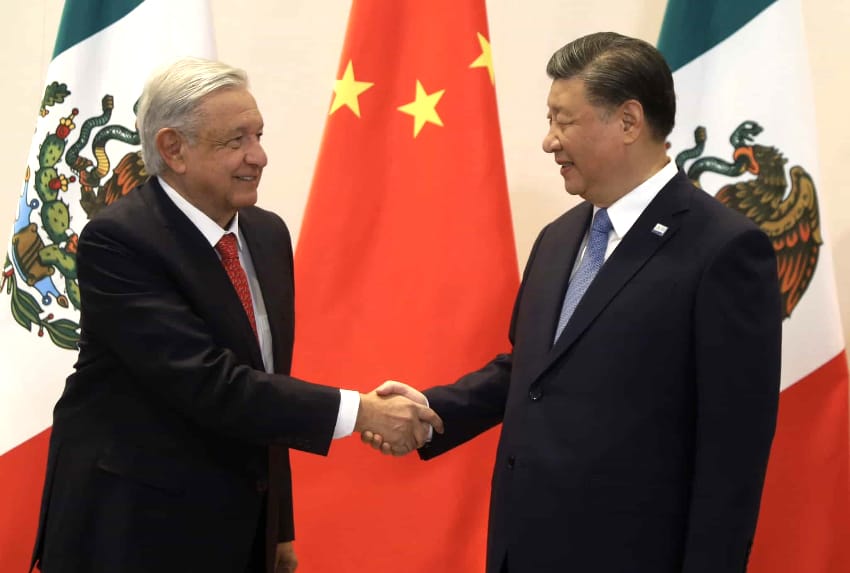

López Obrador said that he requested assistance from Chinese President Xi Jinping when he met with him in San Francisco last November, and “he helped us.”

“The relationship [with China] is good,” he added.

As Mexico-China relations develop, concern is growing in the United States about Chinese investment in Mexico, especially in the auto sector, as companies such as BYD and Jaecoo prepare to open plants here.

In late 2023, Mexico and the United States reached an agreement to cooperate on foreign investment screening as a measure to better protect the national security of both countries.

The plan appeared to be motivated to a large degree by a desire to stop problematic Chinese investment in Mexico, although United States Secretary of the Treasury Janet Yellen said at the time that her investment screening talks with Mexican Finance Minister Rogelio Ramírez de la O were “not just China-focused.”

The presence of Chinese companies in Mexico is likely to become an even bigger bilateral issue in coming years as investment from China continues to grow.

S&P Global said in a recent report that “Chinese investment and exports to Mexico are highly likely to become a headline issue ahead of the 2026 scheduled review of the USMCA,” the North American free trade pact that superseded NAFTA in 2020.

With reports from BN Americas, Reforma and EFE