Mexico had a record-high trade surplus with the United States in the first 11 months of 2024, and maintained its position as the top exporter to the world’s largest economy.

Data published by the United States Census Bureau on Tuesday showed that Mexico had a surplus of US $157.2 billion with the U.S. between January and November, a 12.5% increase compared to the $139.69 billion surplus it recorded in the same period of 2023.

The value of Mexico’s exports to its northern neighbor increased 6.4% annually to a new high of $466.62 billion in the first 11 months of last year.

The value of imports from the United States also increased compared to 2023, but by a more modest 3.5% to reach $309.42 billion.

Mexico’s trade surplus with the United States — which has more than doubled in the last seven years — is a major irritant for U.S. President-elect Donald Trump, who will commence his second term on Jan. 20.

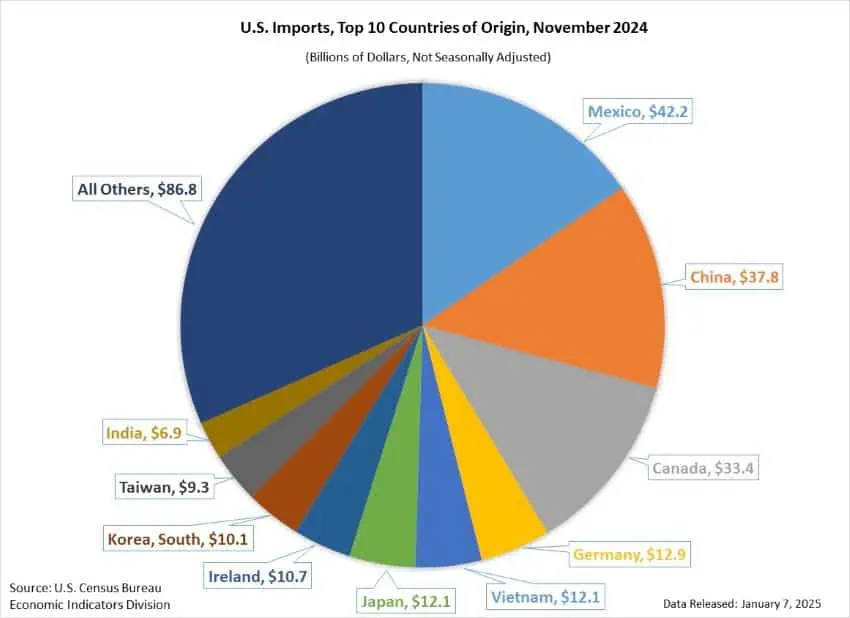

Mexico ahead of China and Canada as top exporter to the US

Mexico’s share of the United States’ $2.98 trillion market for exports in the first 11 months of last year was 15.6%. That percentage represented a slight increase compared to the 15.5% share Mexico had in the same period of 2023.

China was the second largest exporter to the United States between January and November, sending goods worth $401.4 billion across the Pacific Ocean to its trade war adversary. China thus had a 13.5% share of the U.S. export market, down from 13.9% in 2023.

Canada had a 12.6% share of the market between January and November, exporting goods worth $377.24 billion to its southern neighbor. Canada’s share of the U.S. export market dropped a full point from 13.6% in 2023.

The Census Bureau’s latest trade statistics indicate that final 2024 data will show that Mexico was the world’s top exporter to the United States for a second consecutive year. Mexico surpassed China to take the No. 1 position in 2023.

Mexico and the United States were also each other’s largest trade partners in the first 11 months of last year. Two-way trade increased 5.2% annually to $776.04 billion.

Mexico’s surplus with the US raises Trump’s ire

Trump has long been critical of Mexico’s trade surplus with the United States, and it was a significant factor in his desire to terminate NAFTA, which was replaced by the United States-Mexico-Canada Agreement, or USMCA, during his first term as president.

However, Mexico’s surplus with the United States has only increased in recent years, at least in part due to the trade war between the United States and China that Trump initiated.

The El Economista newspaper reported that Mexico’s surplus increased 146% between 2017 and 2024, whereas it only increased 3.6% between 2010 and 2017. The trade war between the U.S. and China began in early 2018.

During an interview with NBC’s “Meet the Press” program last month, Trump railed against the trade deficits the United States is recording with both Mexico and Canada.

“We’re subsidizing Canada to the tune of over $100 billion a year. We’re subsidizing Mexico for almost $300 billion,” he said, significantly exaggerating the United States’ trade deficits with both countries.

“We shouldn’t be — why are we subsidizing these countries? If we’re going to subsidize them, let them become a state. We’re subsidizing Mexico and we’re subsidizing Canada and we’re subsidizing many countries all over the world,” Trump said.

“All I want to do is I want to have a level, fast, but fair playing field,” he added.

On Tuesday, just before announcing his intention to rename the Gulf of Mexico the Gulf of America, Trump once again noted that the United States has “a massive deficit with Mexico.”

He plans to implement new tariffs or increase existing ones to combat trade imbalances between the United States and its trade partners, although a 25% duty he has pledged to impose on all Mexican exports is, according to Trump himself, aimed at getting Mexico to do more to stop the flow of drugs and migrants to the U.S.

There are differing views over whether trade deficits are bad for a country, as the Council on Foreign Relations noted in an article published during Trump’s first term as president.

“Many economists and trade experts do not believe that trade deficits hurt the economy, and warn against trying to ‘win’ the trade relationship with particular countries. Others, however, believe that sustained trade deficits are often a problem,” the article said.

With reports from El Economista