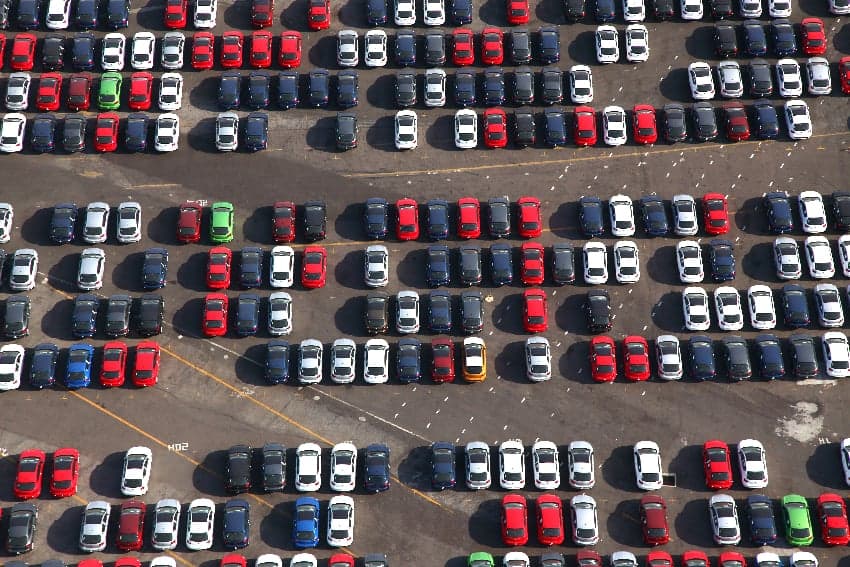

More than 300,000 light vehicles were manufactured in Mexico last month, the highest total for July in seven years, according to official data.

The national statistics agency INEGI reported Tuesday that 302,309 cars and light trucks (including SUVs and pickups) rolled off production lines in July, a 2.7% increase compared to the same month of 2023.

General Motors produced the most vehicles in Mexico last month, followed by Nissan, Volkswagen and Stellantis.

While production increased on an annual basis in July, light vehicle exports decreased 1.56%, according to INEGI. A total of 271,469 units were shipped abroad, down from 275,765 in July 2023.

Odracir Barquera, general director of the Mexican Automotive Industry Association, attributed the small decline in exports to a downturn in the automotive market in the United States.

On a positive note, it was just the third time ever that light vehicle exports exceeded 270,000 units in the month of July.

Mexico on track to have a record year for vehicle production

In the first seven months of 2024, light vehicle production increased 4.9% to 2.29 million, according to INEGI. If production continues at the same pace in the final five months of the year, close to 4 million light vehicles will be manufactured in Mexico in 2024. That would be a record high.

Just over three-quarters of all light vehicles made in Mexico between January and July were light trucks, while just under one-quarter were cars.

Exports up more than 8% this year

Despite the slight decrease in July, exports of light vehicles increased 8.44% in the first seven months of 2024 to reach 1.98 million units.

Almost 80% of those vehicles were shipped to the United States. The next biggest export markets for Mexican-made vehicles were Canada, Germany and Brazil.

GM is the top auto producer and exporter in Mexico

Production

Detroit-based General Motors made more than 503,000 light vehicles in Mexico in the first seven months of the year, a 22.5% increase compared to the same period last year.

The company has plants in Toluca, México state; Silao, Guanajuato; Ramos Arizpe, Coahuila; and San Luis Potosí city.

The next biggest manufacturers of light vehicles in Mexico between January and July were:

- Nissan: almost 383,000 units, a 9% annual increase.

- Stellantis: more than 248,000 units, an 8.8% annual decline.

- Volkswagen: more than 232,000 units, a 24.1% annual increase.

- Ford: more than 227,000 units, a 4.7% increase.

Honda recorded the largest year-over-year production increase. The Japanese company’s Mexico output increased 24.8% to more than 117,000 units between January and July.

Toyota recorded the largest annual decrease in production. It made just over 123,000 vehicles in the first seven months of the year, a 23.5% decline compared to the same period of 2023.

Exports

GM exported more than 458,000 Mexican-made vehicles in the first seven months of the year, a 17.5% annual increase.

The next biggest exporters of Mexican-made vehicles were:

- Nissan: more than 266,000 units, a 25.6% annual increase.

- Ford: almost 230,000 units, an 11.9% increase.

- Stellantis: more than 215,000 units, a 13.7% annual decrease.

- Volkswagen: more than 188,000 units, a 29.4% increase.

Honda recorded the largest year-over-year increase in exports. It shipped more than 129,000 units abroad between January and July, a 72.3% increase compared to the same period of last year.

Audi recorded the biggest annual decline in exports. The German company, a subsidiary of Volkswagen, shipped just over 80,000 light vehicles out of Mexico, a 26.4% decline compared to the first seven months of 2023.

Vehicle sales in Mexico up 12% this year

INEGI reported that 833,411 light vehicles were sold in Mexico between January and July, a 12.03% increase compared to the same period of 2023.

Nissan was the most popular brand among Mexican consumers, followed by General Motors, Volkwagen, Toyota and KIA.

A total of 73,466 vehicles made by Chinese companies — Chirey, MG, Great Wall Motor, JAC and Motornation — were sold in Mexico in the first seven months of the year. Chinese vehicles thus accounted for 8.8% of total light vehicle sales in Mexico between January and July.

JAC is the only Chinese company that currently makes vehicles in Mexico, but some others, including major electric vehicle manufacturer BYD, have announced plans to open plants here.

Green vehicle sales surge 80%

According to Guillermo Rosales, president of the Mexican Association of Automotive Distributors, 65,232 hybrid and electric vehicles were sold in Mexico in the first seven months of the year, an 80.2% increase compared to the same period of 2023.

Electric vehicles accounted for 23% of all green vehicle sales, while hybrids and plug-in hybrids accounted for 70.7% and 6.1%, respectively.

With reports from El Economista and El Financiero