We are no doubt living in uncertain and anxious times. Since the elections, both the Mexican peso and the local stock market have taken a hit. A day doesn’t go by without someone warning of the risks facing the country — water scarcity, lack of infrastructure, insecurity, insufficient energy, threats to the rule of law, etc.

Sentiment can go from wildly optimistic to cautiously optimistic to extremely concerned. Add in the upcoming U.S. election, and the uncertainty only increases. So how can one get a perspective that is more fact-based to assess things on the ground?

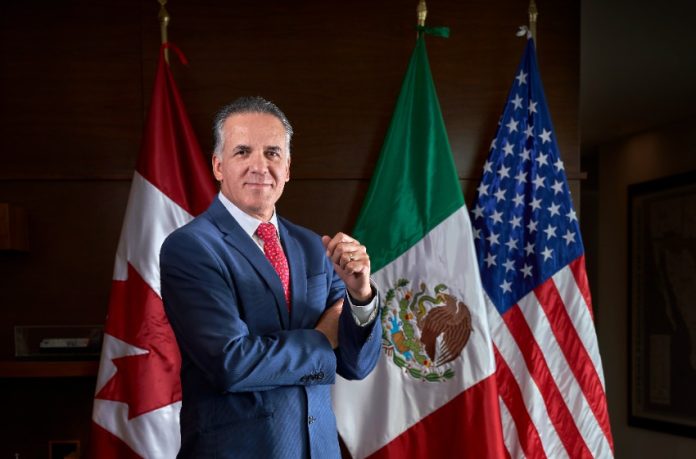

With that question in mind, I recently did an interview with Oscar Del Cueto Cuevas, president of the Canadian Pacific Kansas City de México (CPKCM) railroad company and of the Mexican Railway Association (AMF).

Railways require large investments with long-term payback periods, they touch most parts of the economy and they touch most parts of the country. As a result, understanding what’s going on with the railroads can give useful insights into the real economy.

CPKC was formed in 2023 with the merger of the Canadian Pacific and Kansas City Southern railways, creating the first and only single-line transnational railroad linking the United States, Canada, and Mexico.

CPKC has a 20,000 mile network connecting 12 ports across the three countries. Currently an average of 28-32 CPKC trains, each with an average of 240 containers, cross the US/Mexico border every day. The company has a flagship service called the Mexico Midwest Express from San Luis Potosí in central Mexico to Chicago that makes the trip in 98 hours. For some perspective, the average time of shipping a container from Shanghai, China to Chicago is 30-40 days.

As you might imagine, CPKC does business with many of the major companies that do business in North America. Here are some key takeaways from my interview:

On Sheinbaum and trains

Mexico’s President-elect Claudia Sheinbaum is very pro-railways, said Del Cueto. As a lifelong environmentalist, she understands the potential for Mexico to improve highway congestion and dramatically reduce overall freight CO2 emissions by shifting more freight from highways to railways. On average, the CO2 footprint of moving freight long distances by railway is 75% lower than by semi truck. A train running on the CPKC line on average takes 300 semis off of the highways.

On improving efficiency at the U.S.-Mexico border

The amount of train cargo moving across the U.S.-Mexico border is huge and will continue to grow quickly. Currently at the Nuevo Laredo border crossing, there is only one track line. This means that trains run north for six hours, then trains run south for six hours, then again north for six hours, and finally south again for 6 hours, said Del Cueto. This process is repeated each and every day. As a result, traffic is congested — currently there are 7,200 containers crossing each day on all intermodal trains. A second track line on the bridge is under construction, to be finished by the end of the year. This will allow continuous train traffic to run either north or south and will increase the capacity to nearly 70 trains per day, equivalent to 16,800 containers.

On increased freight shipping speed in Mexico

The speed of train cargo moving between Mexico’s west coast ports like Lázaro Cárdenas and the U.S. border is already fast, and about to get a lot faster. Mexico already has a huge advantage over Asia on freight travel time. Investments being made on the track and specifically in the Celaya bypass will reduce the time from the ports to the U.S. border to 20-22 hours — a speed improvement of over six hours.

On passenger train projects in Mexico

Passenger rail projects are not over with the Maya Train, said Del Cueto. The long-debated passenger rail line from Mexico City to Querétaro, and then further north all the way to Laredo at the U.S.-Mexico border, is still very much a possibility.

In early July, CPKC will be completing a feasibility study for the Mexico City to Querétaro portion that will analyze costs, estimate passenger numbers and evaluate the options of existing track (on which freight trains also run) versus independent (dedicated passenger rail) track.

Independent track of course would be significantly faster, but would likely take much longer and be significantly more expensive. Earlier this week, Sheinbaum announced her plans to move ahead with this and other passenger train projects.

On the future of North American trade

Del Cueto is extremely bullish on the future of North American trade, noting that Mexico is now the largest trading partner with the United States, and highlighting the record amounts of foreign direct investment (FDI). He sees companies in every industry expanding their existing operations in Mexico, and as a result looking for more opportunities to nearshore an increasing amount of their operations here.

Del Cueto concluded by saying that nearly every business leader he speaks with is very positive about the trends going forward, specifically citing the recent downward move of the peso against the US dollar and the solid cabinet announcements for the upcoming administration.

With our finger on the pulse of Mexico through the lens of CPKC — on the ground, across industries and across the country — the future looks very promising indeed.

This article is part of Mexico News Daily’s “Canada in Focus” series. Read the other articles from the series here.

Travis Bembenek is the CEO of Mexico News Daily and has been living, working or playing in Mexico for over 27 years.