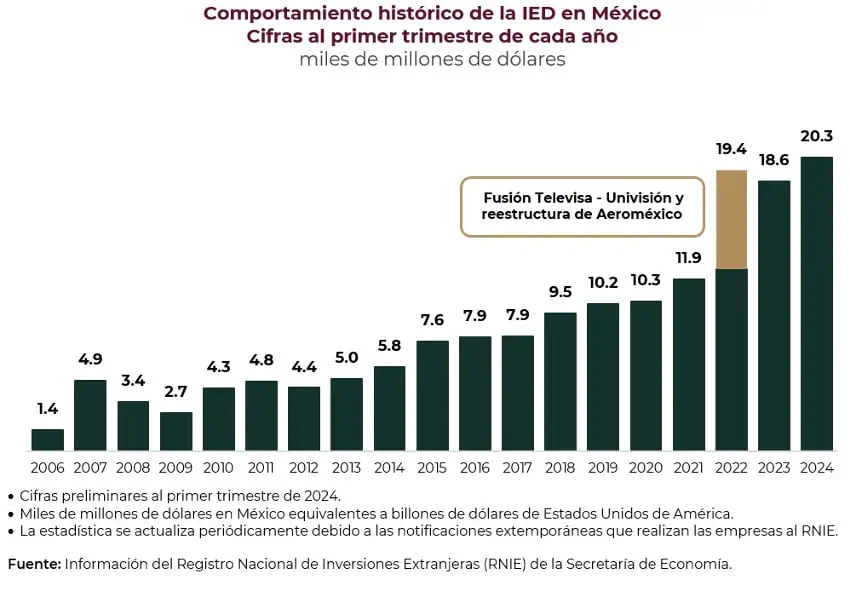

Foreign investment in Mexico hit a new record high in the first quarter of 2024, with Mexico FDI increasing 9% annually to exceed US $20.3 billion, according to preliminary data.

The Economy Ministry (SE) reported Tuesday that FDI in Mexico was $20.313 billion between January and March, an increase of almost $1.7 billion compared to the same period of last year.

Foreign investment in Mexico in the first quarter was double that received in the same period of 2019 — President Andrés Manuel López Obrador’s first full year in office, and four times higher than the $5 billion received between January and March 2013, when Enrique Peña Nieto was beginning the first full year of his presidency.

The $20.31 billion first quarter result is equivalent to 59% of the $36.06 billion in FDI Mexico received last year.

The record-high FDI result comes at a time when Mexico is aiming to capitalize on the growing nearshoring trend. The SE reported late last month that foreign companies made 93 investment announcements between Jan. 1 and April 15, and that $36.15 million in FDI for Mexico was consequently expected to flow into the country in the next two or three years.

But only 3% of the FDI Mexico received in the first quarter of the year — around $600 million — represented new foreign investment in Mexico, down from 5% in the same period of 2023. The percentage figure is well below the 13% contribution that new investment made to the total Mexico FDI last year and the 48% contribution it made in 2022.

The SE said that 97% of Mexico FDI between January and March — a total of $19.6 billion — was reinvestment of profits by foreign companies and investors that already had a presence in the country.

Loans and payments between companies of the same corporate group contributed around $100 million to the Mexico FDI total, a figure equivalent to less than 0.5% of the total.

While the federal government would no doubt be disappointed that the new investment portion of FDI wasn’t higher amid what has been described as a nearshoring “boom” in Mexico, it chose to focus on the positives.

“As the result of the country’s economic stability and the good business environment, the reinvestment of profits reached a new record high for a second consecutive year,” the SE said in a statement, adding that “this reconfirms foreign investors’ confidence in the country.”

For his part, López Obrador highlighted the “historic record” in the “arrival of foreign investment” in Mexico in the first quarter and remarked that the capital represents jobs, income and “well-being” for Mexican workers.

“There is no economic stagnation,” he told reporters at his Wednesday morning press conference. “There continues to be progress with justice in our country.”

Which countries made the biggest Mexico investments?

The SE reported that 52% of the Mexico FDI total — $10.61 billion — came from United States companies and investors.

The next biggest foreign investors, according to their country of origin, were:

- Germany, $1.74 billion, or 9% of the FDI total.

- Canada, $1.7 billion, or 8% of the total.

- Japan, $1.43 billion, or 7% of the total.

- Argentina, $840 million, or 4% of the total.

- Switzerland, $764 million, or 4% of the total.

- South Korea, $641 million, or 3% of the total.

- Netherlands, $530 million, or 3% of the total.

- Spain, $351 million, or 2% of the total.

- Brazil, $164 million, or 1% of the total.

Over 90% of the Mexico FDI total in the first quarter of the year came from companies and investors based in the 10 countries listed above.

Which states in Mexico saw the most investment?

Mexico City was easily the largest recipient of FDI among the country’s 32 federal entities.

Just over $12 billion — or 59% of the Mexico FDI total — was invested in the capital, where numerous foreign companies have offices. An infographic published by the SE showed that Banamex (part of the U.S. company Citi), J.P. Morgan and Coca-Cola were among the companies that invested in Mexico City between January and March.

The next biggest recipients of FDI in the first quarter of the year were:

- Nuevo León, $1.35 billion, or 7% of the total.

- Baja California, $1.08 billion, or 5% of the total.

- Veracruz, $685 million, or 3% of the total.

- Chihuahua, $683 million, or 3% of the total.

- México state, $675 million, or 3% of the total.

- San Luis Potosí, $664 million, or 3% of the total.

- Guanajuato, $597 million, or 3% of the total.

- Jalisco, $593 million, or 3% of the total.

- Querétaro, $489 million, or 2% of the total.

Over 90% of the Mexico FDI total for the first quarter of the year went to the 10 states listed above.

Sectors with the most outside investment

Just over $8.5 billion, or 42% of the total of first-quarter Mexico FDI, went to the manufacturing industry. The transport equipment industry (which includes Mexico’s large auto sector), the beverages and tobacco industry, the food industry and the chemicals industry were among the top recipients of manufacturing FDI, the SE said.

After manufacturing, the largest recipients of FDI by sector in the first quarter of the year were:

- Financial services, $5.15 billion, or 25% of the total.

- Mining, $2.37 billion, or 12% of the total.

- Transport, $1.27 billion, or 6% of the total.

- Wholesale, $1.04 billion, or 5% of the total.

- Retail, $598 million, or 3% of the total.

- Temporary accommodation, $329 million, or 2% of the total.

- Mass media, $290 million, or 1% of the total.

Mexico News Daily