Custom officials at Puerto Vallarta International Airport (PVR) in Jalisco arrested a Canadian tourist after he was found carrying a large sum of cash and undeclared checks.

According to the federal Attorney General’s Office, officials seized two checks worth a total of $148,000, as well as $3,500 and 30,260 pesos in cash. It was not specified whether the dollars were Canadian or another currency.

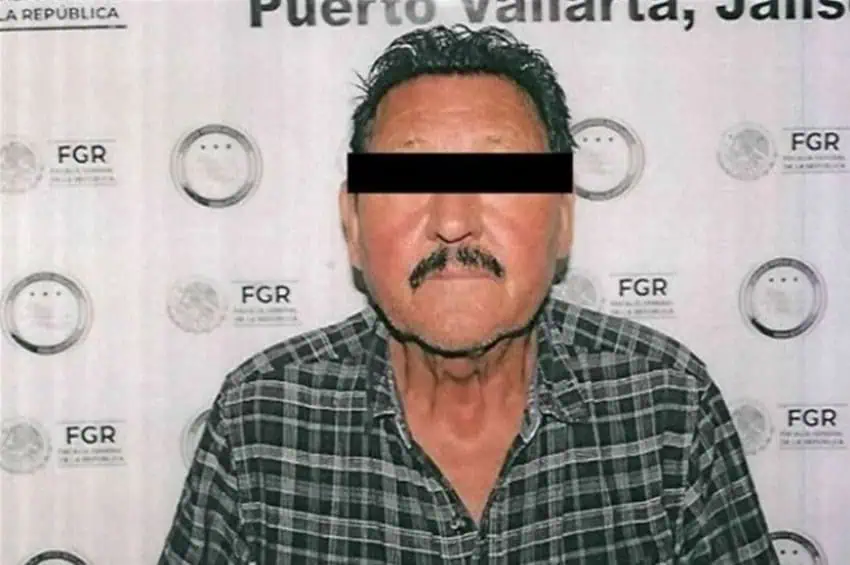

In total, the detained man identified as Jerry “A,” was carrying over US $30,000.

Mexican law says that when entering or leaving the country, people carrying amounts of cash, national or foreign checks, money orders or any other document receivable or a combination of these, whose value exceeds US $10,000, are required to declare the amount to the customs authorities. Failure to do so will carry a fine of 20% to 40% of the amount allowed.

If the undeclared amount is greater than US $30,000, punishment can range from three months to six years in prison or five to 15 years in prison, depending on whether the resources are of legal or illegal origin.

Jerry “A” was handed over to the Federal Attorney General’s Office, which in turn referred him to a specialized judge. The judge ruled the arrest legal and ordered him to be subject to trial, the Attorney General’s Office said on Jan. 3.

As a precautionary measure, the accused will remain in prison during the trial at the Preventive Prison Precinct in Puente Grande, Jalisco.

Jerry “A” isn’t the only international traveler to get in trouble at the Puerto Vallarta airport recently. In December l, customs officials at PVR deported a Czech family after immigration authorities said they failed to comply with the requirements to enter the country.

“Their failure to comply with the requirements to enter the country is based on various sections of the Immigration Law and its regulations, which were recorded in their rejection report,” according to an INM statement reviewed by Milenio newspaper.

In an interview with Milenio, Robert Svecová, who was traveling for the holidays to Puerto Vallarta with his wife and two kids, said that they were mistreated by the National Guard, who wouldn’t speak English, and were never told the reason for their deportation.

The National Migration Institute (INM) told Milenio that the family failed to prove their lodging during the 10-day-holiday they said they had booked.

With reports from Milenio and El Informador