Jan. 1, 2024 will mark the 30th anniversary of the commencement of the North American Free Trade Agreement, or NAFTA.

Superseded by the United States-Mexico-Canada Agreement, or USMCA, on July 1, 2020, the three-way pact had a profound impact on the Mexican economy during its 26-year lifespan – both good and bad, depending on who you ask.

One thing that cannot be disputed is the enormous boost NAFTA gave to Mexico’s trade relationship with its northern neighbor, which just happens to be the world’s largest economy.

A decade after it took effect, the International Monetary Fund said in a 2004 paper that the result of the free trade agreement “has been to spur a dramatic increase in trade and financial flows among the NAFTA partners and to contribute to making North America one of the most economically integrated regions in the world.”

Almost 20 years later, North America remains a highly-integrated economic area, and the value of Mexico’s exports to the United States hit a new record high in the first nine months of 2023.

As Mexico’s exports to North America – and the world – increased over the past 30 years or so, so too did foreign direct investment (FDI) to Mexico.

This edition of “Mexico in Numbers” examines a range of data related to Mexican exports and FDI inflows, with special emphasis on how export revenue and investment have increased in recent decades.

Unless indicated otherwise, the data in this article comes from official Mexican sources, including the Economy Ministry and the national statistics agency INEGI.

The path to (what should soon be) US $600 billion

Mexico’s exports in 1993 – the year before NAFTA took effect – were worth $51.88 billion, with almost 83% of that total coming from shipments to the United States.

In 1994, the total value of exports shot up 17% to $60.88 billion as the value of goods sent to the U.S. increased by $8.7 billion, or 20%, in the space of a year.

In 2000 – the seventh full year with NAFTA in effect – the total value of Mexico’s exports reached $166.12 billion, an increase of 220% compared to 1993.

Apart from a couple of hiccups, the value of Mexico’s exports continued to grow through the first decade of the new century to reach $298.47 billion in 2010, an impressive 475% increase compared to the pre-NAFTA level.

In 2014 – as the three-way trade pact celebrated 20 years of existence – the value of exports hit $396.91 billion before declining 4% to $380.55 billion in 2015 after NAFTA turned 21 on Jan. 1 of that year.

There was another decline in 2016, but the value of exports Mexican exports hit a new milestone the following year, exceeding $400 billion for the first time ever. The $409.43 billion value of exports in 2017 was almost 700% higher than the 1993 pre-NAFTA level.

In that year, exports to the U.S. accounted for 80% of the total, with shipments to Canada, Mexico’s other NAFTA partner, representing just under 3%.

The value of Mexico’s exports continued to increase in 2018 and 2019 before hitting a roadblock in the form of the COVID-19 pandemic in 2020, when production at many factories shut down for part of the year.

Despite the decline, export revenue remained above $400 billion, and the sector came roaring back in 2021 – the first full year of USMCA – to hit a new record high of $494.76 billion, an increase of almost 19% compared to 2020.

The value of exports rose again in 2022, increasing 17% to hit $578.19 billion. That monetary figure is a whopping 1,014% higher than the $51.88 billion in export revenue generated in 1993.

In the first nine months of this year, exports were worth $441.53 billion, a 2.7% increase compared to the same period of 2022.

If the 2.7% increase is maintained until the end of the year, Mexico’s exports will be worth just under $594 billion in 2023. Will 2024 be the year they hit and go beyond $600 billion?

Where do Mexico’s exports go?

Given that the world’s largest economy is on its doorstep, it’s no surprise that Mexico sends the lion’s share of its exports to the United States.

In the first nine months of 2023, about 83% of Mexico’s export revenue came from goods sent to the United States, with shipments to other trade partners around the world generating the remaining 17%.

Data for 2021 provides a more detailed breakdown of the destination of Mexican exports.

In that year, 80.8% of Mexico’s export revenue came from shipments to the U.S., while 2.6% came from goods sent to Canada, meaning that 83.4% of total export income came from USMCA partners.

The following were Mexico’s top 10 export destinations in terms of revenue in 2021:

- United States, $399.97 billion, 80.8% of the total.

- Canada, $13.06 billion, 2.6%.

- China, $9.25 billion, 1.9%.

- Germany, $7.54 billion, 1.5%.

- South Korea, $6.91 billion, 1.4%.

- Spain, $4.91 billion, 1%.

- India, $4.26 billion, 0.9%.

- Japan, $4.18 billion, 0.8%.

- Brazil, $3.65 billion, 0.7%.

- Colombia, $3.43 billion, 0.7%.

Which sectors are Mexico’s largest exporters?

The manufacturing sector brought in 89% of Mexico’s export revenue in the first nine months of 2023. Just over 35% of the $393.06 billion in manufacturing sector export revenue came from shipments of vehicles and auto parts, while almost 65% came from non-auto manufactured goods.

Oil shipments brought in 5.6% of export revenue in the first nine months of the year, while agricultural products accounted for 3.7% of the total.

The mining sector generated 1.6% of Mexico’s export revenue between January and September.

Mexico’s growing share of the market for exports to the U.S.

Mexico was the United States’ largest trade partner in the first nine months of 2023, with two-way trade totaling $599.79 billion, according to U.S. government data.

Mexico had a 15.5% share of the export market to the U.S., ahead of Canada and China, which both had a 13.7% share in the first nine months of 2023.

In 2023, Mexico has displaced China as the biggest exporter to the United States after the Asian economic powerhouse had a 16.5% share of the market in 2022, ahead of Mexico, which had a 14.2% share.

![]()

Data shows that Mexico’s share of the export market to the U.S. has gradually increased over the past 15 years or so. It had an 11.1% share in 2009, a 13.1% share in 2015 and a 13.7% share in 2020.

Meanwhile, China’s share of the same market has declined in recent years amid its trade war with the U.S.

China had a 21.2% share of the market in 2015, but that figure dropped to 17.9% in 2020 and continued to fall in subsequent years to reach 13.7% in the first nine months of 2023.

Exports as a percentage of GDP

Mexico’s exports contributed to 43.4% of national gross domestic product in 2022, according to the World Bank. That figure has trended upwards over the past 50 years or so.

Exports made up 25.4% of GDP in 2000, 29.7% in 2010 and 34.5% in 2015.

Imports to Mexico

Imports to Mexico have also increased significantly over the past 30 years.

Mexico imported goods worth $65.36 billion in 1993, but that figure shot up 21.4% to $79.34 billion in 1994 after NAFTA took effect.

In 2000, the value of imports to Mexico was $174.45 billion, while in 2010 imported goods were worth $301.48 billion, a 361% increase compared to the pre-NAFTA level.

The value of imports went above $400 billion for the first time in 2017 and exceeded $500 billion in 2021.

Imports increased again in 2022, hitting a record high of $604.61 billion. Mexico thus recorded a trade deficit of $26.42 billion last year.

Imports were worth $451.62 billion in the first nine months of 2023, a 0.9% decline compared to the same period of last year.

How many free trade agreements does Mexico have?

The levels of growth in exports and imports seen in recent decades quite simply wouldn’t have occurred without the existence of free trade agreements between Mexico and various nations/economic blocs around the world.

Mexico has 15 FTAs covering trade relationships with more than 50 countries, according to Tetakawi, a company that helps foreign firms establish a presence in Mexico.

They include the USMCA, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, the Mexico-European Union Agreement and the Pacific Alliance.

Foreign direct investment in Mexico over the past 40+ years

FDI in Mexico could exceed $40 billion in 2023. Forty years ago it totaled just $683.7 million.

Data shows that foreign investment in Mexico has generally trended upward since 1980, although there have been years when FDI has decreased significantly from the previous year, including in 1995 in the wake of the Mexican peso crisis, and in 2020 due to the COVID pandemic.

Let’s first take a look at how FDI inflows changed in 10 year intervals between 1980 and 2010.

Just over $1.6 billion in foreign investment came into Mexico in the first years of the 80s, but that figure more than doubled to reach $3.72 billion in 1990, when former president Carlos Salinas de Gortaria held office for the Institutional Revolutionary Party, or PRI.

In 2000 – the final year of more than seven decades of uninterrupted PRI rule – FDI totaled $18.24 billion, representing a remarkable 1,025% increase compared to 20 years prior.

In 2010, with ex-president Felipe Calderón in office, FDI was $27.18 billion, an increase of 49% compared to 2000.

FDI hit a record high of $48.35 billion in 2013, a figure that was boosted significantly by the sale of brewer Grupo Modelo to Anheuser Busch InBev, a Belgian multinational.

While FDI hasn’t exceeded $40 billion since 2013, it has remained above $30 billion every year with the exception of COVID-plagued 2020, when foreign investment was $28.21 billion.

FDI was $31.82 billion in 2021 and $36.3 billion in 2022. In the first nine months of this year, FDI was $32.92 billion, according to preliminary data.

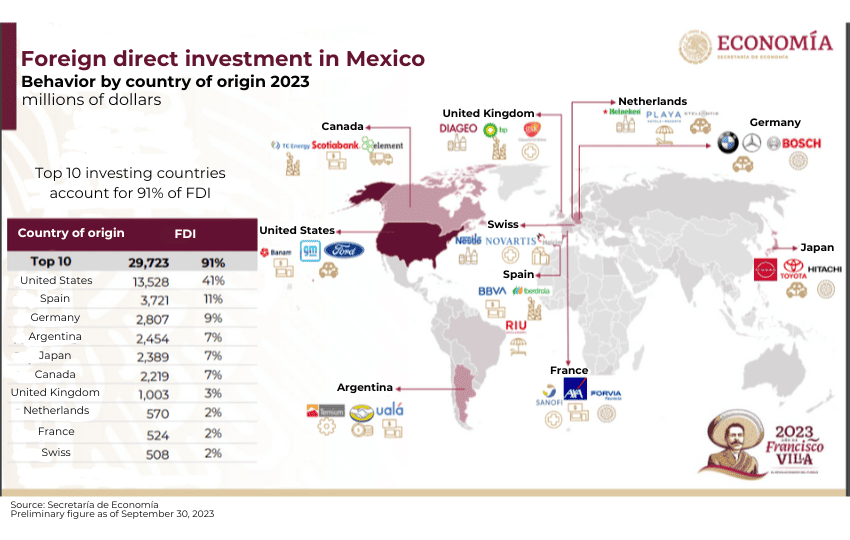

Which countries are the biggest investors in Mexico?

Just over two-fifths of the total FDI in Mexico in the first nine months of the year — 41% or $13.5 billion — came from the United States.

Spain ranked second, investing $3.7 billion or 11% of the FDI total in Mexico between January and September.

Ranking third to tenth for FDI in Mexico in the first three quarters of 2023 were:

- Germany, $2.8 billion, 9% of the FDI total.

- Argentina, $2.5 billion, 7%

- Japan, $2.4 billion, 7%

- Canada, $2.2 billion, 7%

- United Kingdom, $1 billion, 3%

- Netherlands, $600 million, 2%

- France, $500 million, 1.5%

- Switzerland, $500 million, 1.5%

Which industries currently receive the most FDI?

Over half of the FDI in the first nine months of 2023 — $17.5 billion or 53% — went to the manufacturing sector. Within that broad industry, 44% of investment went to the transport equipment sector, which includes automakers.

The remaining 56% of the $17.5 billion investment in manufacturing went to the following sectors: metal (14%); beverages and tobacco (13%); chemicals (8%); computer equipment (5%); energy generation equipment (5%); plastic and rubber (3%); food (3%); machinery (1%); other manufacturing industries (4%).

The financial services industry was the second largest recipient of FDI, attracting $7.2 billion or 22% of the total between January and September.

The mining industry ranked third, receiving $2.9 billion or 9% of total FDI, followed by the following sectors:

- Temporary accommodation (hotels, Airbnb, etc.), $2.2 billion, or 7% of the total

- Transport, $1.3 billion, 4%

- Construction, $759 million, 2%

- Wholesale retail, $582 million, 2%

The correlation between FDI and export data

As a significant portion of FDI goes to Mexico’s manufacturing sector, it makes sense that exports would increase as more investment flows into the country.

The value of exports increased 220% between 1993 and 2000, while FDI rose by a not overly dissimilar 272%. The data suggests that the increase in FDI – in addition to NAFTA –was a factor in Mexico’s improved export performance.

Between 2000 and 2022, the value of exports rose 248% while FDI increased by just under 100%.

By Mexico News Daily chief staff writer Peter Davies (peter.davies@mexiconewsdaily.com)