The number of mezcal producers in Mexico almost tripled between 2011 and 2017, statistics show, but makers warn that quality of the beverage will drop with the recent expansion of the designated denomination of origin areas.

There were 68 registered mezcal brands in 2011 but by last year that number had risen to 201.

Oaxaca dominates production of the spirit, with 87% of all mezcal made in the southern state followed by Puebla with 4.2%, Zacatecas with 2.8% and Guerrero with 2.5%, according to market analyst Iscam.

The remaining 3.5% comes from producers in San Luis Potosí, Tamaulipas, Michoacán, Durango and Guanajuato.

However, the percentages will likely change soon after certain municipalities in México state, Morelos and Aguascalientes were added last month to the list of authorized mezcal producing areas, a move that established makers described as a “bitter pill” to swallow.

They say that not only will the inevitable proliferation of producers lead to an influx of poor-quality mezcal on the market, it will also lead to lower prices for the distilled beverage, whose popularity is increasing both domestically and internationally.

Hipócrates Nolasco, president of the Mezcal Regulatory Council (CRM), said the ruling by the Mexican Institute of Industrial Property (IMPI) to grant new denomination of origins only took into account the natural presence of the maguey plant in the states that received the designation and not factors associated with its ancestral value.

“[Let’s be] careful with what we are showing the world, what could happen now is that wherever there is maguey could be considered as potential mezcal territory. In that case, Cuba, the United States, Guatemala, El Salvador and Colombia, among others, could request a permit to produce mezcal,” he said.

The group Nolasco heads is already looking at ways it can fight the IMPI decision while Oaxaca Governor Alejandro Murat has also pledged to fight the ruling and last month led a mezcaleros protest in Mexico City.

Established mezcal producers are aiming to defend what is an increasingly lucrative industry.

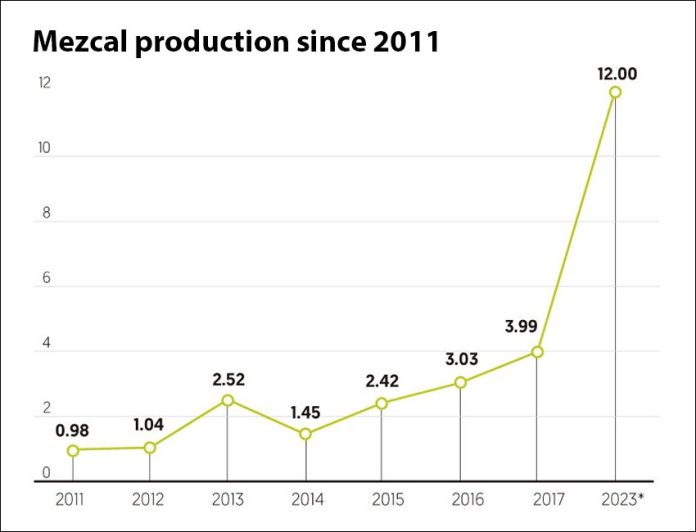

CRM data shows that the industry grew 32.8% last year to reach sales of almost 3.9 billion pesos (US $207 million), while production was up 26.6% to just under 4 million liters.

The growing market has attracted investment from large multinational beverage companies such as Bacardi, Jose Cuervo and Pernod Ricard.

Julián Luna, producer of the mezcal brand Cordón Cerrado, said that he expects the market to continue to grow, predicting that production will triple to 12 million liters by 2023 but he added that small-batch producers will retain their appeal.

“Consumers are looking for a connection to the land, a different beverage from small producers that is therefore exclusive and has undergone fewer industrial processes.”

Source: El Financiero (sp)