Pemex’s debt is at its lowest level in 11 years, the state oil company’s CEO said Wednesday.

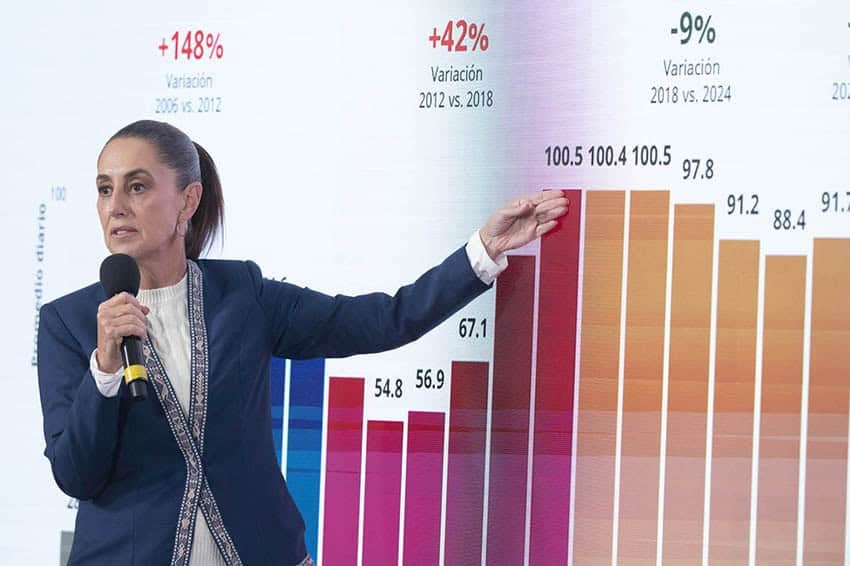

At the end of 2025, Pemex’s debt was an estimated US $84.5 billion, according to data presented by Víctor Rodríguez Padilla at President Claudia Sheinbaum’s morning press conference.

The company’s debt declined 13.4% compared to the end of 2024 and 20.1% compared to the end of 2018.

Former president Andrés Manuel López Obrador took office in December 2018, and in early 2019 unveiled a rescue plan for Pemex, whose debt at the time was well above $100 billion.

Referring to the years between 2007 and 2018, Rodríguez told reporters that Pemex’s debt increased 129% during the “neoliberal period.”

“This trend has been reversed,” the Pemex CEO said.

He highlighted that the state oil company’s debt has declined by $20 billion compared to 2018, attributing the reduction to “financial discipline, rigorous planning, operational efficiency and close coordination with the Ministry of Finance and Public Credit, and the Energy Ministry.”

With those two ministries, “we drew up the 2025-2035 strategic plan and the Comprehensive Capitalization and Financing Strategy,” Rodríguez said.

“The result of this joint work is … [that] currently the financial debt [of Pemex] is the lowest it has been in the past 11 years,” he said.

Pemex’s debt reached a peak of $113.2 billion in 2020, according to the data presented by Rodríguez. However, debt declined in each of the five subsequent years.

Rodríguez highlighted that Pemex’s credit ratings with major rating agencies had been upgraded “for the first time in 11 years,” reflecting “the credibility and confidence in the actions adopted to guarantee the sustainability of our beloved oil company.”

Among the objectives of the 10-year strategic plan presented last August are for Pemex to achieve oil production of 1.8 million barrels per day, increase natural gas production and support renewable energy initiatives.

‘Financial engineering’ helped reduce Pemex’s debt, says analyst

The reduction of Pemex’s debt was related to “various liability management operations,” the El Economista newspaper reported.

Among those operations, El Economista reported, were the “issuance of pre-capitalized notes (P-Caps), that allowed liabilities to be exchanged for cheaper debt” and “the repurchasing of bonds and the issuance of new securities for more than $13 billion in order to soften the maturity profile.”

Gonzalo Monroy, director of the energy consultancy GMEC, told the Reforma newspaper that while Pemex’s debt declined, a mechanism was used that replaced some of the company’s debt with public debt.

Víctor Gómez Ayala, director of analysis at the Finamex brokerage house, told Reforma that the improvement in Pemex’s finances is the result of “financial engineering” that caused a deterioration in the federal government’s financial position.

Pemex paid more than 390 billion pesos to suppliers in 2025

Rodríguez described Pemex’s “payment to suppliers” as “another key element” in the “financial strengthening” of the state oil company.

“In September 2025, the Investment Financing Program was implemented in coordination with the National Bank of Public Works and Services and the Finance Ministry. With this program and resources generated by the company, payments to suppliers reached more than 390 billion pesos [US $22.37 billion],” he said, referring to the figure for the entirety of 2025.

“This inter-institutional initiative has made it possible to normalize … [payments to suppliers], strengthen production chains and regain the trust of thousands of companies that work with Pemex across the entire country,” Rodríguez said.

The data he presented showed that Pemex’s outlay on payments to suppliers actually decreased last year, even though the CEO indicated that the company is doing a better job in meeting its obligations. For years, Pemex has struggled to pay suppliers in a timely manner.

Pemex’s production increased in 2025

Rodríguez presented data that showed that Pemex produced an average of 1.8 million barrels of “liquid hydrocarbons” per day in December, up from 1.678 million barrels per day in the first month of last year.

“In annual terms, national production increased by more than 122,000 barrels per day,” the CEO said.

He said that Pemex also made improvements to its infrastructure and “optimized” the operation of its refineries.

“The processing of crude reached 1.5 million barrels per day, taking into account the Deer Park refinery” in Texas, Rodríguez said.

“The Tula and Dos Bocas [Olmeca] refineries stand out for the volume [of crude they] processed: up to 280,000 barrels and 320,000 barrels per day, respectively,” he said.

Rodiguez asserted that the refining of oil is “a profitable business for the benefit of the people of Mexico,” telling reporters that Pemex has an average profit margin of $12 per barrel.

Pemex has seven refineries in Mexico as well as the facility in Deer Park, Texas.

Mexico is aiming to achieve self-sufficiency for gasoline, but failed to achieve the 2023 target set by López Obrador.

Sheinbaum: ‘Pemex has recovered’

President Sheinbaum said that refining more oil in Mexico “creates sovereignty because gasoline used to be imported [in greater quantities].”

“That is very important. Processing oil in Mexico is fundamental,” she said.

“Secondly, the public company has recovered. They dedicated 36 years to trying to disappear Pemex,” Sheinbaum said, referring to governments in the period between 1982 and 2018.

“But today Pemex has recovered,” she said.

According to estimations from the Center for Economic Budget and Research, a think tank, the federal government allocated more than $137 billion to the rescue of Pemex between 2019 and 2025.

Despite that investment, Pemex’s debt “only” declined by $20 billion in that period, the Reforma newspaper pointed out.

With reports from El Financiero, La Jornada, El Economista, Reforma and El País