President Claudia Sheinbaum on Wednesday rejected a legislative proposal in the United States to impose a 5% tax on remittances sent out of the country by non-citizen immigrants.

The proposal is outlined in the so-called “One Big Beautiful Bill,” a budget bill put forward by the U.S. House Committee on Ways and Means, whose chair is Republican Party Congressman Jason Smith.

The bill’s approval would have a significant impact on Mexican immigrants in the United States, who send over US $60 billion to Mexico each year in remittances.

According to the bill, “in general” the proposed tax “shall not apply to any remittance transfer with respect to which the remittance transfer provider is a qualified remittance transfer provider and the sender is a verified United States sender” — i.e. a U.S. citizen.

The Associated Press reported that the proposed tax “would cover more than 40 million people, including green card holders and nonimmigrant visa holders, such as people on H-1B, H-2A and H-2B visas.”

The bill could be approved by the United States House of Representatives as soon as next week, after which it would be sent to the Senate.

💸 Mexico received $66B in remittances last year, but some countries rely on them much more. pic.twitter.com/ZD1aP1ECgx

— latinometrics (@LatamData) July 16, 2024

At her morning press conference on Wednesday, Sheinbaum indicated that she shared the view on Mexican senators that the proposal to impose a 5% tax on remittances is an “injustice” and “discriminatory.”

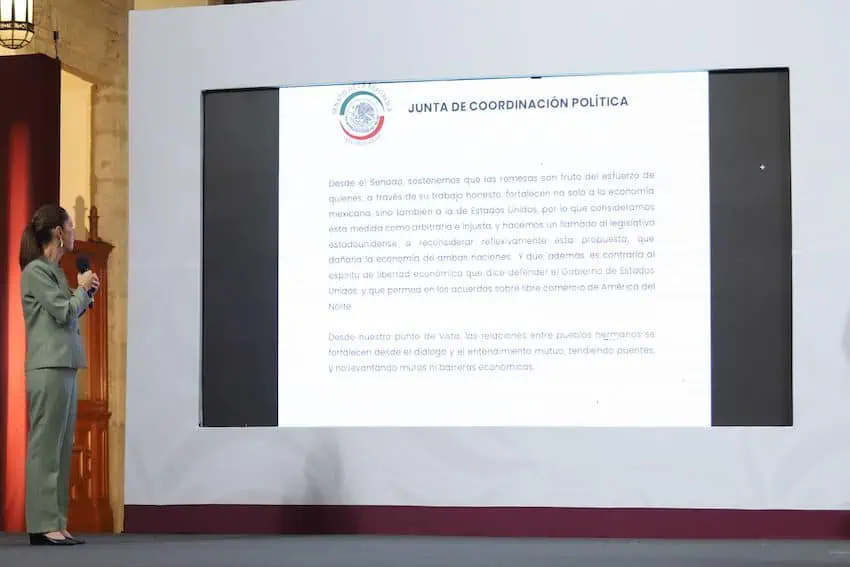

She noted that the Senate on Tuesday released a statement expressing its opposition to the proposed tax.

Sheinbaum said that “all the political parties” condemned the proposal, and questioned why it is being considered when Mexicans in the United States “already pay taxes.”

“All the Mexicans who live in the United States pay taxes, whether they have documents or not,” she said.

“They all pay taxes, there are even states that already tax remittances,” Sheinbaum said, apparently referring to a fee imposed on remittances sent from Oklahoma.

“All [the Mexican senators] said ‘no, … we don’t agree with this injustice,’ which is discriminatory,” she said before reading out the Senate statement.

Senate: Proposed tax is ‘contrary to the spirit of economic freedom’

In its statement, the Mexican Senate said that a federal tax on remittances in the United States would amount to “an unjust double taxation” of “migrant workers.”

The Senate highlighted that 80% of the earnings of immigrants “stays in the United States economy, improving the well-being of those who live there.”

“We call for restraint in the face of this proposal given that technical projections that have been carried out show that the imposition of a tax or fee on remittances would only disincentivize the use of regular and formal ways [to transfer funds], leading many migrants to seek alternatives outside the financial system to send money to their families,” said the statement endorsed by the Senate leaders of all major Mexican political parties.

José Iván Rodríguez Sánchez, a research scholar at the Baker Institute Center for the U.S. and Mexico, also said that immigrants would seek ways to get around a federal tax on remittances.

“There’s going to be a black market,” he said.

“We know that if you have to send money for your relatives and they need that money, you will try to find ways to send $100 and not $95,” Rodríguez said.

In its statement, the Senate described remittances as “the fruit of those who through their honest work strengthen not just the Mexican economy but also that of the United States.”

“For that reason we consider this [proposed tax] measure as arbitrary and unjust, and we call on the U.S. legislature to thoughtfully reconsider this proposal, which would harm the economy of both countries,” said the upper house of Congress.

“In addition, [the proposed tax on remittances] is contrary to the spirit of economic freedom the United States government says it defends, and which permeates in the agreements on free trade in North America,” the statement said.

“From our point of view, relations between brotherly peoples are strengthened through dialogue and mutual understanding, building bridges and not erecting walls or economic barriers,” the Senate said.

Mexico News Daily