Around 7.5% of the more than US $58 billion in remittances sent to Mexico last year could be linked to drug trafficking, according to a Mexican think tank.

Central bank data shows that Mexicans living and working abroad, mainly in the United States, sent a record $58.5 billion home last year.

The think tank Signos Vitales said in a report that there is evidence that at least $4.4 billion of that amount is ill-gotten gains that was sent electronically to Mexico as part of a money laundering process.

Mexican criminal organizations ship large quantities of narcotics to the United States and therefore it is unsurprising that money is sent back to Mexico. While drug money undoubtedly flows into Mexico as cash, the Signos Vitales report indicates that significant amounts of ill-gotten gains may also make their way here electronically, as the vast majority of remittances are sent that way.

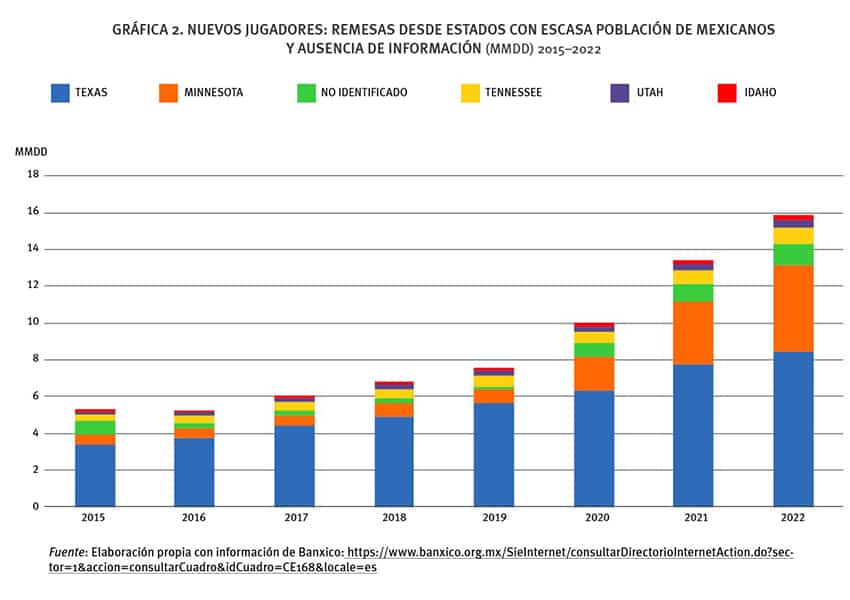

Among the evidence cited by Signos Vitales is that large amounts of money were sent to Mexico from U.S. states with small Mexican populations and that monthly remittances to over 200 municipalities exceeded the number of households located in them.

The U.S. state from which the third highest amount in remittances emanated in 2022 — about 8% of the total — was Minnesota, which ranked behind only California and Texas despite having a Mexican population of just 200,000, or 0.5% of the total number of Mexican-origin residents in the United States.

Entitled “Euforia de las remesas: éxodo, lavado de dinero y auge económico” (Remittance Euphoria: Exodus, Money Laundering and Economic Boom), the report also noted that the amount of money sent to Mexico from Minnesota increased 585% between 2018 and 2022.

“The most powerful reason to believe that it’s not Mexicans sending remittances from Minnesota is that the amount sent — some $4.7 billion — is equivalent to the gross annual income of all … Mexicans [in the state], making it financially impossible,” the report said.

The combined increase in remittances in the same period from that state as well as Idaho, Maine, Montana, New Hampshire, North Dakota, Tennessee and Utah — all of which have relatively small Mexican populations — was just under 279%, Signos Vitales said.

The data-focused think tank also said that remittances originating from unknown locations increased 332.5% between 2018 and 2022.

In addition, it said that 227 municipalities received more remittances than households on a monthly basis last year. The number of monetary transfers received by 32 of those municipalities was at least two times higher than the number of households, Signos Vitales said.

The $4.4 billion figure calculated by Signos Vitales is in fact based solely on “those municipalities … where 100% of the homes receive more than one [monetary] transfer per month,” Signos Vitales said.

“… It’s an introduction to the magnitude of the [money laundering] problem, which we believe is enormous,” the think tank added.

InSight Crime, a think tank and media organization focused on researching organized crime in the Americas, said in 2021 that “organized crime groups in Mexico have shown a remarkable ability to adapt amid the global health crisis, and the record number of remittances sent back to the country from the United States presents a clear money laundering opportunity.”

“… Organized crime groups often use such transfers to launder money and hide its illicit origins,” InSight Crime said.

In its report, Signos Vitales also noted that the total monetary amount of remittances sent to Mexico has increased sharply in recent years.

“There has to be an explanation for the astounding increase in the past few years. It’s impressive that it’s gone from around $21 billion [a decade ago] to nearly $60 billion,” said the think tank’s president Enrique Cárdenas, an economics professor.

“There are parts that look strange, things that don’t happen in the rest of the country,” he said.

However, Cárdenas also said that the “enormous increase in remittances in recent years is the reflection of a very complex socioeconomic situation that got worse in the pandemic” and caused migration of Mexicans to the United States to “grow again.”

The United States government’s extensive support for the U.S. economy amid the coronavirus-induced downturn was cited by many analysts as the main reason for the record remittance levels during the pandemic.

Another factor cited by Signos Vitales is an increased presence of refugees, migrants and temporary workers (including digital nomads) in Mexico, at least some of whom presumably receive money transfers from their country of origin.

With reports from EFE, El Economista and Bloomberg