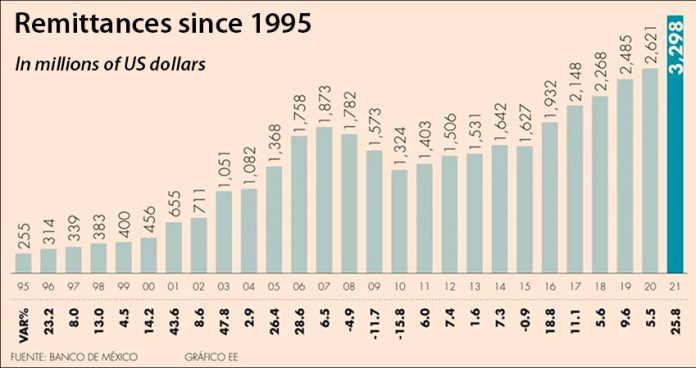

After a record-breaking 2020 during which Mexicans working abroad sent more than US $40 billion home, remittances spiked 25.8% in January compared to the same month a year earlier.

Remittances totaled just under $3.3 billion last month, according to the central bank, an increase of almost $700 million over the January 2020 total. It was the best January on record for remittances and the biggest first-month spike in percentage terms since January 2006 when transfers surged 28.6%.

Generous economic support amid the coronavirus pandemic in the United States – the chief source of remittances to Mexico, an exchange rate that allows one greenback to buy approximately 20 pesos and the economic downturn and job losses here are seen as the main factors behind the strong remittance levels in 2020 and early 2021.

Approximately 1.8 million Mexican families benefited from the remittances sent last month, according to the Bank of México, and the average transfer was $343, up 1.2% compared to December.

A total of 9.6 million transfers were made in January, a decrease of 11.1% compared to December but an increase of 18.1% over the same month of 2020. Almost 99% of the transfers were made electronically with cash accounting for just $26.5 million, or less than 1% of the total value of remittances.

Bank of México data also shows that Tijuana, Baja California, received more money in family remittances in 2020 than any other municipality. About $626 million flowed into the northern border city last year, a 30.1% increase compared to 2019.

Guadalajara, Jalisco, ranked second followed by Puebla city; Morelia, Michoacán; and Álvaro Obregón, a borough of Mexico City. Rounding out the top 10 were Ciudad Juárez, Chihuahua; Culiacán, Sinaloa; León, Guanajuato; Zapopan, Jalisco; and Oaxaca city.

Gabriela Siller, head of economic and financial research at Banco Base, said that without the record remittances in 2020, Mexico’s economic contraction would have been even greater than the 8.5% slump, which was the worst economic result since the Great Depression.

“Without the accelerated recovery of exports in the second half of the year and in the absence of an increase in remittances, the GDP decline would have been 10.5%,” she said.

Pamela Díaz, an economist with French bank BNP Paribas, said that remittances, along with exports to the United States and foreign and domestic investment in Mexico, will play a key role in the economic recovery in 2021.

High levels of remittances provide a substantial boost to domestic consumption because most people who receive them are prone to spending rather than saving the money.

President López Obrador predicts that the economy will grow 5% this year while the International Monetary Fund and the World Bank are forecasting GDP expansion of 4.3% and 3.7%, respectively.

Source: El Economista (sp)