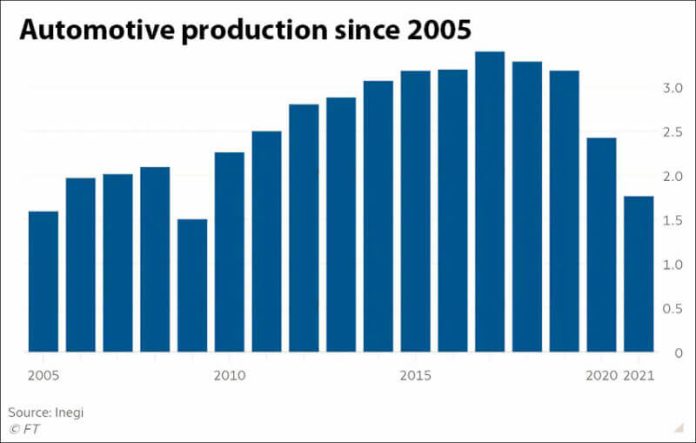

Once a magnet for billions of dollars in investments and rapid job creation, Mexican monthly auto production and sales are languishing at their lowest levels in a decade as the industry is pummeled by the pandemic and semiconductor chip shortages.

The chip problems felt around the world are hitting North America particularly hard, and Mexico is experiencing an outsized impact since it relies on autos for more than 3% of its gross domestic product. Data published on Monday showed that auto production in Latin America’s second-largest economy in October was at its lowest for that month since 2011.

The auto supply chain issues could hit GDP by 1% this year, according to a Bank of México estimate from August, and the problems will probably last well into next year. The uncertainty ahead was compounded by changing U.S. consumer tastes, the transition to electric vehicles and the Mexican government’s energy policy, analysts said.

“We’re in a really tricky moment for the sector,” said Adrián de la Garza, chief economist for Mexico at Citi. “It’s not clear that going forward we’ll see a big rebound in foreign investment.”

That could be a drag on Mexico’s already fragile economic recovery, which contracted suddenly in the third quarter. While the sector has long benefited from North America free trade agreements, an eagerly awaited boom from factories moving from Asia to be closer to the U.S. is yet to materialize.

This year, automakers had hoped to recover fully from COVID-19 shutdowns in 2020. But supply chain bottlenecks caused by persistent waves of the virus, raw material shortages and other factors severely restricted the supply of chips. That has led to stoppages and production cuts across many factories.

“We recovered from the plant closures but then we basically ate up all the raw materials and ran out of components,” said Guido Vildozo, senior market analyst at IHS Markit. “We are at a point where . . . if anything is derailed, then the domino effect is very severe.”

Almost 1 million Mexicans work in the auto industry. Entire regions of the country depend on the factories owned by big names such as General Motors and Nissan and their suppliers. More than 80% of production is for export, mostly to the U.S.

Many emerging markets that made autos were seeing a hit of 0.1 to 0.2% of GDP from the chip problems, said analysts at Capital Economics. But in Mexico, the Czech Republic and Hungary, where the sector comprises a larger chunk of the economy, the overall impact was likely to be greater than 1% of GDP, including spillover effects, they added.

Tatiana Clouthier, Mexico’s economy minister, warned the chip problems were having an impact on the wider economy, and said her team had been working within the U.S.-Mexico High Level Economic Dialogue (HLED) to strengthen the supply chain for chip parts.

“We’re in the HLED working on this, from issues around training and reskilling of people needed for new chip models, to defining which parts each side will do,” she told the Financial Times. “It’s one of our priorities.”

Another reason why Mexico has been hit hard is that it still makes many smaller cars, which have been deprioritized in terms of which chips the companies order. There is also a clear trend among consumers in the U.S., Mexico’s main auto market, away from smaller passenger vehicles toward light trucks. Mexico is rebalancing but cannot go as fast as the changing trends.

“You essentially have a double whammy,” said Vildozo. “You’re constrained on semiconductor availability but then the industry also looks at what generates revenue.”

Local car sales have also plummeted, with the industry having suffered its worst October for sales in a decade, reflecting a lack of inventory. “It’s a complicated moment, without a doubt,” said Jorge Vallejo, president and chief executive of Mitsubishi Motors Mexico.

The short-term chip issues are hurting now, but several longer-term trends are also converging on the horizon.

A recent proposal to nationalize future lithium production and prioritize dirtier, more expensive state energy was unlikely to help Mexico’s case in the global fight for electric vehicle investment, said analysts.

Clouthier said that her team was working with the private sector and academia on the transition to electric vehicles, particularly around battery production.

“We’re doing what we have to do to move forward in a mixed system,” she said.

The shift has the potential to reshape the geography of auto manufacturing around the world, said José Zozaya Délano, executive president of the country’s auto industry body AMIA.

“Mexico . . . has shown over the years it has the capacity and qualified people to make vehicles with advanced technology,” he said. “We’re ready, but we need to do a better job in attracting investment and giving confidence in it.”

© 2021 The Financial Times Ltd. All rights reserved. Please do not copy and paste FT articles and redistribute by email or post to the web.