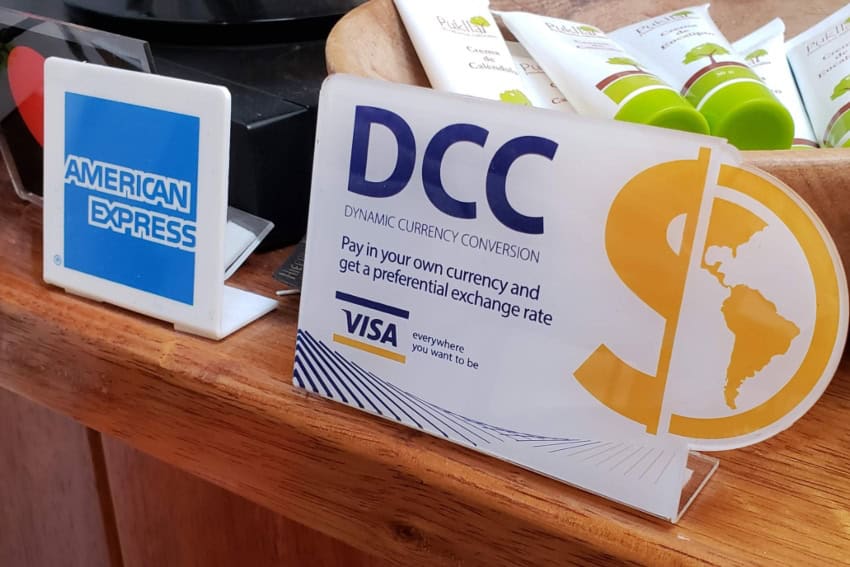

Whether you’re a long-term expat or a tourist visiting Mexico on vacation, a dubious service the financial industry refers to as “dynamic currency conversion” (DCC for short) can cost you a bundle in excess fees when shopping with a foreign credit card.

Don’t know what I’m referring to? Let me explain.

How dynamic currency conversion works

When you’re shopping or dining in Mexico and use a foreign credit card to pay, the merchant’s payment processor (often referred to as a terminal) identifies the card’s country of origin based on the issuing bank. In some cases, this triggers a choice of two payment options.

In this situation, a salesperson may ask if you prefer to pay in U.S. dollars (or whatever your home currency is) instead of Mexican pesos. While the question may seem harmless, in truth, it’s anything but.

When a consumer agrees to pay in their home currency instead of the local one, the purchase price displays on the terminal’s screen, with the merchant’s exchange rate and any fees shown beneath it, in smaller print. If the customer declines, the purchase is made in Mexican pesos, and the cardholder’s bank does the currency conversion at its own rate.

Transacting in your home currency, or accepting DCC, invariably means paying a higher price due to the merchant’s bigger exchange rate markups.

How much more will you pay with DCC? It varies by merchant since they’re the ones who set the exchange rate for customers who accept DCC. But the bottom line is that DCC usually works out badly for the consumer.

The subtext of this practice is that merchants are counting on buyers with foreign cards being inexperienced and intimidated to transact in Mexican pesos. When they find a customer that fits the bill, they take advantage.

Now, I’m not blaming front-line staff for ripping off customers. Most store clerks and waiters probably have no idea how a decision like this financially impacts the consumer. But their boss certainly does!

How to protect yourself from DCC

Whenever you use a foreign credit card in Mexico, you must be alert to this practice. If a restaurant, hotel, shop or other business establishment asks if you prefer to pay in dollars (or another foreign currency) instead of pesos, politely but firmly refuse with a “no, gracias.”

Or, do as I do and proactively tell the merchant that you want to pay in pesos when handing them your credit card. This preempts the question.

Sometimes, a merchant may hand you the terminal with both the peso and dollar prices displayed side by side. Always tap the peso price.

In expensive restaurants where there are lots of foreign diners, you may be handed a bill with two totals displayed, one in pesos and the other in U.S. dollars. Circle the amount in Mexican pesos before signing the bill.

While no merchant is obligated to offer the customer an uncompetitive exchange rate on DCC transactions, they almost all do. It seems they can’t help themselves – reputations be damned.

Whenever I’m out buying things, I pay particularly close attention to Mercado Pago terminals, because I know their software is built to offer dynamic currency conversion.

How to fight back when you’ve been DCC’d

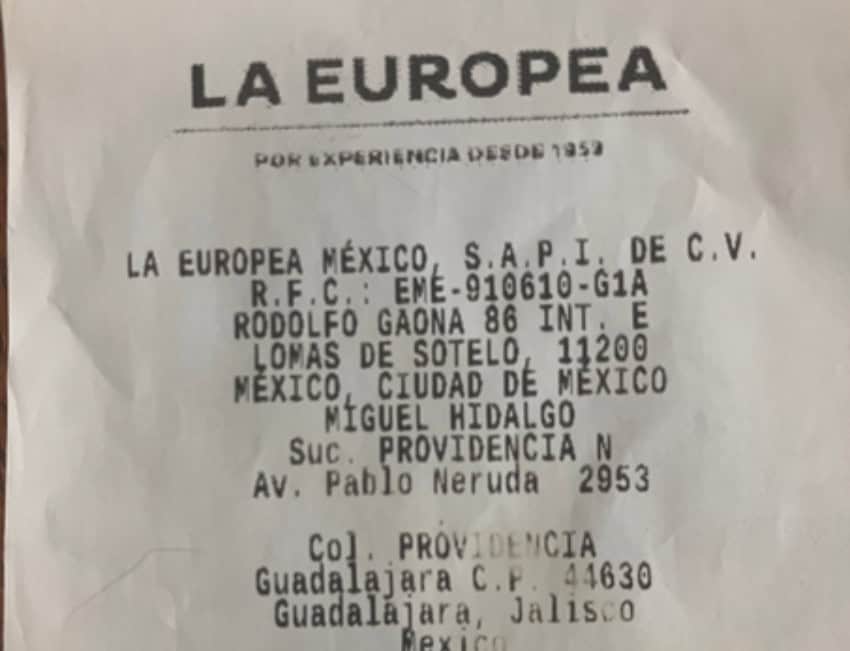

I fell prey to this practice last summer at a gourmet food store I visit regularly in Guadalajara. I’d been chatting with my spouse during checkout, and the clerk proceeded to charge my credit card in dollars without asking me first.

It wasn’t clear that I’d been duped until a few hours later, when I pulled the receipt out of my wallet at home.

By processing my payment in dollars, the sale was roughly US $16 higher than it would have been if I’d paid in pesos. This was thanks to the merchant’s horrible exchange rate, which equated to an 8% markup! Sheesh.

According to Visa and Mastercard policies, consumers have the right to decline dynamic currency conversion when it’s offered. Merchants cannot default the customer to a DCC transaction without their consent.

Disputing purchases with your credit card issuer

If you discover a Mexican merchant has done exactly that — i.e., ringing up your purchase in dollars (or another foreign currency) without asking your preference — ask them to reverse the charge and ring it up again in pesos. If they refuse, then mark the receipt “local currency not offered” and inform the clerk that you will be disputing the charges with your credit card company.

Similarly, if you were pressured to accept payment in a foreign currency instead of the local one, dispute the charge with your card issuer. Be sure to provide the original receipt showing the merchant’s name, location, contact information and the amount charged in dollars.

Your bank will initiate an investigation and, in the best outcome, refund you the excessive fees and/or charge them back to the merchant who ripped you off. I successfully challenged the 8% overcharge mentioned above with Capital One, my credit card issuer, and was reimbursed in a few weeks.

But it’s not always so easy. With some companies, dispute resolutions can drag on for months. Nevertheless, I think it’s worth holding merchants accountable when they rip off buyers paying with foreign cards.

Now, if you were offered the choice of paying in your home or local currency and chose your home currency, there’s no basis to dispute the excess charges after the fact. In this case, chalk it up to “expat education” and pay closer attention the next time you pull out a foreign credit card in Mexico.

Why DCC is becoming more common in Mexico

Mexico has long been a cash-oriented economy. According to the National Survey of Financial Inclusion (ENIF) released in March by the Mexican government, cash was used by 85% of Mexicans when purchasing lower ticket items in 2024. Meaning, those that cost less than 500 pesos.

But things are starting to change thanks to Latin America’s fast-growing financial technology sector, driven by the likes of Mercado Pago, Adyen and others. New products aimed at increasing digital payments in Mexico are rolling out at a rapid clip.

In its second-quarter letter to shareholders, Mercado Libre (the biggest e-commerce platform in Mexico) highlighted the release of dynamic currency conversion for its Mexican business customers using the Mercado Pago payments system.

What this means for anyone shopping here with foreign credit cards is that DCC will be even more prevalent going forward, especially in major cities and tourist destinations.

After discovering that life in Mexico was a lot more fun than working in corporate America, Dawn Stoner moved to Guadalajara in 2022, where she lives with her husband, two cats and Tapatío rescue dog. Her blog livewellmexico.com helps expats live their best life south of the border.