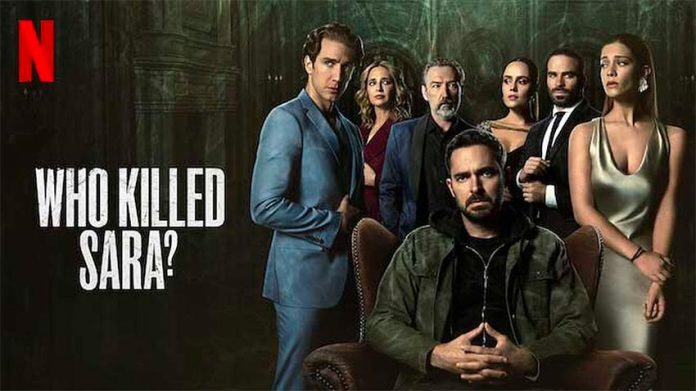

Who killed Sara remains a mystery.

But Netflix’s smash-hit Mexican thriller has revealed Latin America as the latest front in the global streaming war being fought between the world’s biggest media groups.

For giants Disney, Amazon Prime and Netflix, countries such as Mexico with its 126 million population — in addition to the 60 million Hispanics in the U.S., and 600 million Latino market worldwide — represent a juicy growth opportunity.

Indeed, Who Killed Sara? was Netflix’s most popular non-English language show in the U.S. for the first month after it launched in March and one of the streamer’s biggest hits overall, proving to Latin producers that there is a big international market for Spanish-language content.

It is also a tempting target for traditional broadcasters making a painful shift to the digital age.

In mid-April — just before Netflix unveiled disappointing quarterly subscription figures in Latin America, a region that has long been an engine of growth — Mexico’s top broadcaster Televisa and New York-based Univision unveiled a US $4.8-billion content merger.

Bolstered by $1 billion in funding from Japan’s SoftBank, they aim to launch a streaming service next year targeting the global Spanish-language market.

The still-to-be-named venture will face stiff competition: Netflix entered Latin America a decade ago, while the past two years have seen the arrival of Amazon Prime’s video on-demand service and Disney Plus. WarnerMedia is launching its HBO Max platform in the region this month.

But Emilio Azcárraga, executive chair of Televisa, is confident they can pull it off. “Either Univision or Televisa alone would find it impossible to have the scale to generate the cash to be able to be relevant in content production and distribution,” he said. “Together, we have the reach, the size and we have the money.”

He points to the group’s experience in partnering with satellite TV service Sky in the 1990s, aiming to take on far larger rival DirecTV. “Many people said we were totally crazy — how were we going to be able to compete?” he told the Financial Times. “[But now] in the region in which we operate, DirecTV no longer exists.”

Still, it is a tall order for Televisa that has a library of hundreds of thousands of hours of melodramatic soaps known as telenovelas, films and sports, but little experience in producing edgier shows or in tailoring content to what audiences want to watch in the way the streamers do.

Even Disney Plus is not expected to be profitable until 2023 while Netflix only said in January that it expected its cash flow to break even this year, after years of investing heavily in content.

Few local streaming services have succeeded in holding their own against the big global players. Nent, a Stockholm-based group, has managed to do so in part by increasing production of original Nordic drama.

But encouragingly for the new venture, Spanish-language and particularly Mexican-made content is booming in the important U.S. market, according to data provider Parrot Analytics.

The Televisa-Univision venture will use Televisa’s production capabilities and seek to leverage its vast back catalogue. But Televisa spends just $1 billion a year on content compared with Netflix’s $17 billion and Azcárraga did not say how much it would invest in content in future.

“The reality is that Televisa can’t compete with Netflix productions,” said analyst Gilberto García at Barclays.

In addition, at least some of what Televisa-Univision is currently producing appears to be content viewers don’t want. “Since 2015, Univision audiences have fallen more than 50%,” García said.

Alejandro Rojas, director at applied analytics at Parrot Analytics, said it would be essential for Televisa to make a mental shift from just producing large amounts of content to actually analyzing what consumers desired. “It’s a completely different mindset to TV,” he said.

Azcárraga acknowledged that people wanted more than just telenovelas. “Romance always sells [but] there are things we have to do differently . . . we are not closed to anything.”

He sees Televisa-Univision as an attractive shop window for independent producers looking to produce content for the Latin market and highlighted Televisa’s success with films, but did not specify where he wanted to focus as the venture goes head-to-head with film-laden rivals such as Disney.

“It’s like an arms race,” said Rojas. “Everybody needs to produce more.” Indeed, Netflix is planning a new office in Colombia later this year and film 30 new series, films, documentaries and other programs over 2021-2022. It is betting on new Latin productions such as reality dating show Too Hot to Handle and teen drama Control Z to reignite regional growth, according to Ampere Analysis.

But even the streaming giant is faltering in Latin America in a business where scale is everything.

Netflix subscriptions in the region rose less than 1% in the first quarter compared with the end of last year. Total subscribers in Latin America rose 19% last year, following annual rises of 20% in 2019 and 32% in 2018.

“What the pandemic has shown is that people bring forward their paid membership — people who might have subscribed in 2021 subscribed early, so we’re seeing a slowdown now in relation to an increase in growth in 2020,” said Rahul Patel at Ampere Analysis.

Azcárraga said a decision had also yet to be made about whether to make the new service subscription-based or advertising supported.

Televisa’s first-quarter ad sales rose 28% versus the same period last year while content revenues rose 10% and 200,000 subscribers were added. Univision’s own pay-TV venture, PrendeTV, launched in March with some 900,000 subscribers in its first month and core advertising revenues rose 7% in the first quarter.

Marcelo Claure, chief executive of SoftBank’s international arm, told analysts the combined entity “has the potential to be rewarded in the same way as the market rewarded Disney Plus, which is now trading at 35 times EBITDA.”

Televisa’s revenues have been largely flat for four years but net income has plunged. Analysts estimate it trades currently at some six to seven times EBITDA.

“Viewing figures [at Televisa] are definitely better and content has been getting slicker,” said Soomit Datta, analyst at New Street Research. “But they will live or die on the quality of their content.”

© 2021 The Financial Times Ltd. All rights reserved. Please do not copy and paste FT articles and redistribute by email or post to the web.