The Mexican economy is doing well and the country is starting to benefit from the relocation of foreign companies, but in order to take full advantage of the nearshoring opportunity, Mexico needs to address a range of “long-standing” challenges.

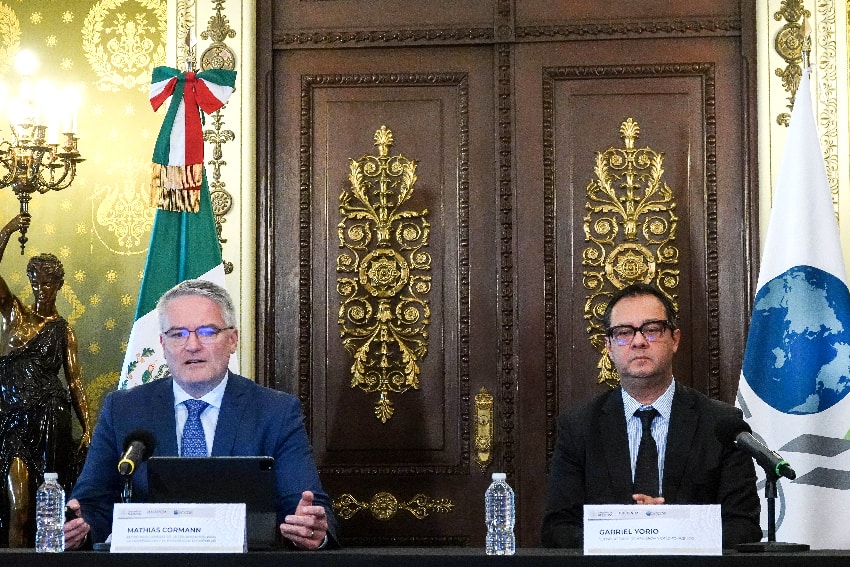

That’s the assessment of the Organization for Economic Co-operation and Development (OECD), which presented its Economic Surveys: Mexico 2024 report in Mexico City on Tuesday.

The positives in the Mexican economy

The OECD described economic growth in Mexico as “resilient” (3.2% last year) and noted that headline inflation is “gradually receding,” although the rate remains above the central bank’s 3% target.

The 38-member intergovernmental organization also acknowledged that “investment is trending up” and “exports have kept their dynamism.”

Indeed, Mexico in 2023 dethroned China as the top exporter to the United States, sending goods worth more than US $475 billion north of the border.

The OECD acknowledged that Mexican exports to the U.S. are now worth more than Chinese ones, and concluded that 2023 export data shows that Mexico “has started to benefit from nearshoring.”

However, “fully harnessing” Mexico’s nearshoring potential, it added, “requires tackling long-standing challenges.”

Managing water efficiently and increasing the use of renewable energy sources among Mexico’s key challenges

Mexico needs to improve water management and increase the use of renewables to capitalize on the nearshoring opportunity, according to the OECD.

Water

“Efficient water management would enhance the reliability of water supply and safeguard the country’s limited resources,” the OECD said in the executive summary of its biennial publication.

“By reducing operational risks and costs and promoting environmental sustainability,” Mexico would become “an even more appealing destination for nearshoring,” the report said.

As things stand, “water governance is highly fragmented, hampering policy coordination and accountability,” the OECD said.

Water is currently at a premium in Mexico as the country continues to grapple with widespread drought. Some observers of the nearshoring phenomenon in Mexico, such as the head economist at brokerage firm Grupo Bursátil México, believe that foreign companies relocating to Mexico will increasingly choose to establish their operations in the south of the country due to a lack of water in northern and central states.

The efficient management of water across the country is no doubt a complex task, but the OECD said that “a mandate from the Supreme Court to issue a General Water Law by August 2024” provides an opportunity to Mexican lawmakers to “improve water governance and regulations, for example by granting the National Water Commission (Conagua) a stronger stewardship role in the sector.”

It also said that Mexico needs to invest in water supply and sanitation infrastructure to reduce leakages and improve water treatment and distribution.

“Currently around 46% of water is lost due to leakages,” the OECD said, citing a 2017 study.

Energy

“Making the most out of nearshoring requires shifting to renewables,” the OECD said.

“With global manufacturing activity increasingly seeking to decarbonize its production processes, Mexico’s abundant renewable energy resources could be a substantial competitive advantage,” the organization said. “However, the share of electricity generated from renewable sources remains low,” at around 10%.

Energy policies implemented by the current federal government have not been conducive to private sector investment in the renewables sector as they favor the state-owned Federal Electricity Commission (CFE) over private and foreign companies. The government has invested in some renewable projects, such as a huge solar park in Sonora, but the CFE remains highly dependent on fossil fuels.

Efforts to transition towards carbon neutrality, the OECD said, “would help to address and mitigate climate change and, at the same time, would help Mexico to maintain and reinforce its trade competitiveness in a global economy that is transitioning towards lower carbon content.”

The organization acknowledged that “private renewables generation has suffered from high regulatory uncertainty” and advocated for “regulations that promote private sector investment in renewables projects and regulatory and legal certainty.”

The government’s nationalistic energy policies have angered its largest foreign investor, the United States, as well as its third largest one, Canada. Both have challenged the policies under USMCA, the North American free trade pact that superseded NAFTA in 2020. The dispute has not yet been settled.

Tax reform is also needed

The OECD offered advice across a wide range of areas, including recommendations aimed at boosting productivity, combating corruption, reducing inequality and bolstering economic growth.

It also said that “higher tax revenues are needed” to maintain fiscal prudence and “to address important spending needs in productivity enhancing areas, such as education, infrastructure, the digital and green transitions, and the fight against corruption and crime.”

The Paris-based organization said that Mexico has the lowest tax-to-GDP ratio among OECD countries, at 16.5%.

“There is room to raise more revenues from the property tax, environmental taxes, and to make the tax system more effective and progressive by reducing tax expenditures benefiting the more affluent,” the OECD said.

One way to increase tax collection, the organization said, is to reduce “the threshold for the top personal income tax bracket” as it is currently very high by international standards.

“The income threshold where single taxpayers face the top statutory tax rate is set at 25 times the average wage in Mexico, while it is six times in the average OECD country,” the OECD said.

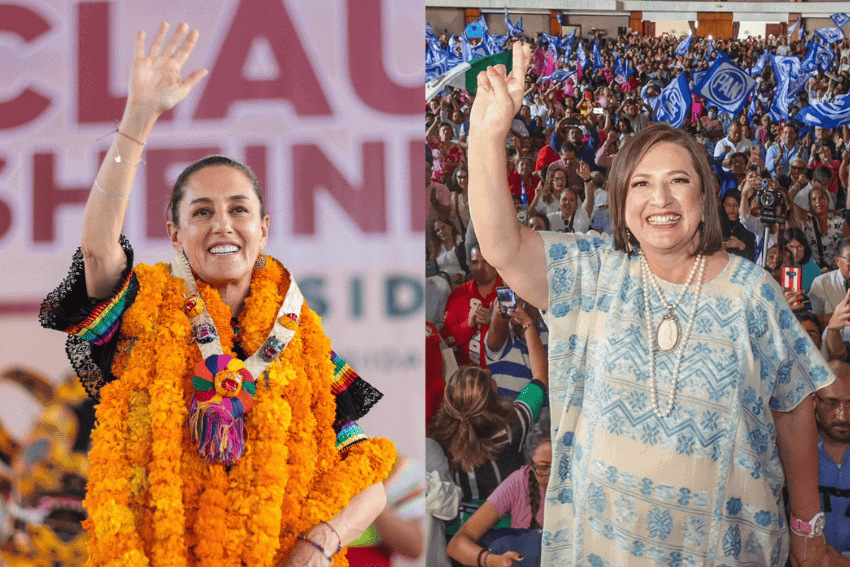

The two leading presidential candidates, Claudia Sheinbaum and Xóchitl Gálvez, were both asked whether they were in favor of tax reform in interviews with the Expansión news organization late last year.

“Not now,” said Sheinbaum, the clear favorite to win the June 2 election, while Gálvez offered a remarkably similar response, saying “not at this time.”

The OECD also advocated the offering of incentives to states in order to increase the collection of vehicle taxes.

Taxes on the purchase, ownership and usage of vehicles “have become an important source of tax revenue for many OECD governments and are increasingly designed to influence consumer behavior for environmental purposes,” the OECD said.

However, in Mexico, “currently less than half of the 32 states collect vehicle taxes,” it said.

“Estimates from the Finance Ministry suggest that [tax] collection could increase by 0.2% with a compliance rate of 70%. The federal government could enhance incentives for states to collect and green this tax, for example by allocating higher federal transfers to those states doing so,” the OECD said.

It also said that tax revenues could be “significantly boosted by reducing informality,” as more than 50% of all workers are employed in the informal sector and thus don’t pay taxes.

“A comprehensive strategy would be needed for that, with actions in different policy areas,” the OECD said.

Mexico News Daily