Cars manufactured in Mexico by Chinese companies could be subject to a hefty import tariff in the United States if Donald Trump succeeds in his bid to return to the White House.

Trump said on Saturday that he would impose a 100% tariff on such vehicles, double the 50% levy he previously declared would apply.

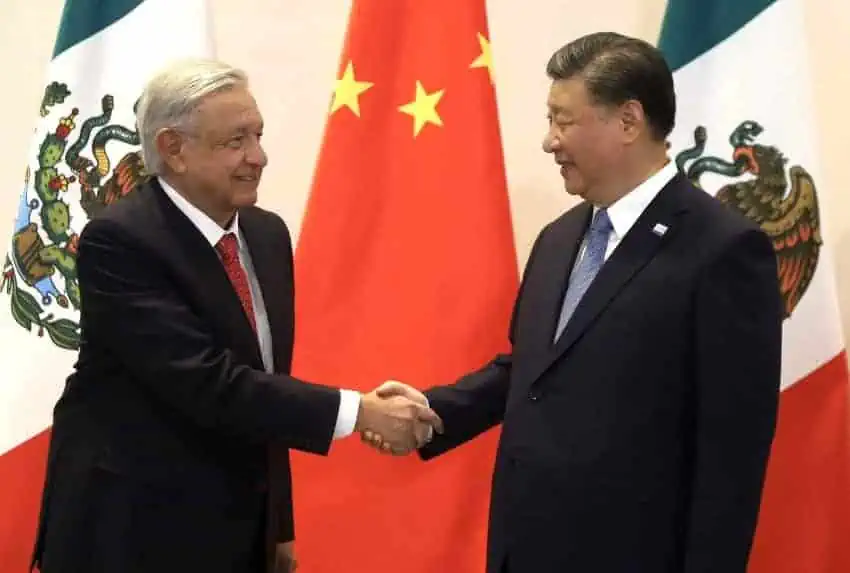

Speaking at a rally in Dayton, Ohio, the 77-year-old Republican Party candidate sent a direct message to Chinese President Xi Jinping.

“Those big monster car manufacturing plants you are building in Mexico right now and you think you are going to … not hire Americans and you’re going to sell the car to us, no. We are going to put a 100% tariff on every car that comes across the lot,” Trump said.

Top electric vehicle (EV) manufacturer BYD and Jaecoo are among the Chinese automakers that have recently announced plans to open plants in Mexico. BYD Americas CEO Stella Li said last month that the company’s plan was to “build the facility for the Mexican market, not for the export market.”

However, many observers believe that Chinese automakers’ main motivation for establishing manufacturing capacity in Mexico is to export to the United States from a country that both neighbors the world’s largest economy and has a free trade agreement with it.

A bipartisan group of United States lawmakers wrote to U.S. Trade Representative Katherine Tai late last year in part to request that the U.S. government be ready to “address the coming wave of [Chinese] vehicles that will be exported from our other trading partners, such as Mexico, as [Chinese] automakers look to strategically establish operations outside of [China] to take advantage of preferential access to the U.S. market through our free trade agreements and circumvent any [China]-specific tariffs.”

Trump, who initiated a trade war with China during his 2017-21 presidency, said Saturday that he wasn’t worried about retaliatory measures from China or any other countries if he imposes high tariffs on imports, including cars made by Chinese companies in Mexico.

“You screw us and we’ll screw you. It’s very simple, very fair,” he said.

Earlier this year, the 45th president of the United States threatened to put a 50% tariff on Chinese cars made in Mexico, and has also proposed levies as high as 60% on other Chinese goods as well as a 10% duty on imports from other countries.

Apparently seeking to depict his proposed tariffs as essential to the survival of the U.S. auto sector, Trump said Saturday there would be a “bloodbath” if he didn’t defeat U.S. President Joe Biden in the Nov. 5 U.S. presidential election. He sought to clarify his use of the word in a post to his social media site Truth Social on Monday after claims were made that he was predicting something similar to the 2021 attack on the United States Capital Building if he loses to Biden.

“The Fake News Media, and their Democrat Partners in the destruction of our Nation, pretended to be shocked at my use of the word BLOODBATH, even though they fully understood that I was simply referring to imports allowed by Crooked Joe Biden, which are killing the automobile industry,” Trump wrote.

Vehicles made in Mexico are currently not subject to tariffs when exported to the United States provided they comply with regional content and labor rules specified in the USMCA, the North America free trade pact that superseded NAFTA in 2020.

Chinese companies with plants in Mexico could source components from Mexico-based Chinese auto parts makers, helping them to comply with regional content rules.

In a letter sent in January to the U.S. lawmakers who raised concerns about the presence of Chinese automakers in Mexico, Trade Representative Tai acknowledged that “existing rules of origin” applicable to the automotive sector “have left openings” for Chinese companies operating outside China to benefit from “MFN [most-favored nation] treatment” in the U.S. “or preferential treatment under free trade agreements.”

She also said the Biden administration was looking at ways to make existing tariffs “more strategic.”

If Trump returns to the White House and imposes a 100% tariff on Mexican-made Chinese cars, it will be up to a new Mexican president to respond as the country’s next leader will be sworn in on Oct. 1.

The two leading candidates, Claudia Sheinbaum of the ruling Morena party and Xóchitl Gálvez of a three-party opposition alliance, both opted for the United States when asked in interviews with Expansión Política to choose between that country and China. Their responses suggested they would not be prepared to fight a U.S. tariff on Mexican-made Chinese cars on Beijing’s behalf.

Mexico and the U.S. are “economically integrated” whereas “there is no free trade agreement with China,” said Sheinbaum, the heavy favorite to win the June 2 election.

“… The relationship with China exists and it has to continue existing, but the agreement with the U.S. has to be maintained and strengthened as well,” Sheinbaum said of the USMCA free trade pact, which also includes Canada.

A review of the USMCA will take place in 2026, during which the United States could seek to modify it in order to stop or limit the capacity of Chinese companies to benefit from the pact by establishing a presence in Mexico. A growing number of companies from the East Asian economic powerhouse are setting up shop in Mexico as the country’s nearshoring trend gathers momentum.

The Brookings Institution, a Washington D.C.-based think, said earlier this month that should Trump win in November, “he will likely suggest that President Biden was not tough enough with Mexico and Canada and threaten to terminate the agreement if U.S. concerns are not addressed.”

“It seems unlikely that a Trump administration — that pushed so hard for a review clause [in USMCA], and with the leverage the U.S. has as the much larger economy among the three parties — would pass up the opportunity to use the review clause to negotiate better terms,” it added.

Brookings also said that “the reliance of Mexico on the U.S. market is expected to lead Mexico to support the continuation of the agreement, although the list of contentious issues is likely to be longer under a Sheinbaum administration than one led by Gálvez.”

With reports from Bloomberg