Production at Mexican factories declined more than 1% annually in the second quarter of 2024, a slowdown the Bank of Mexico (Banxico) partially attributed to weak manufacturing activity in the United States.

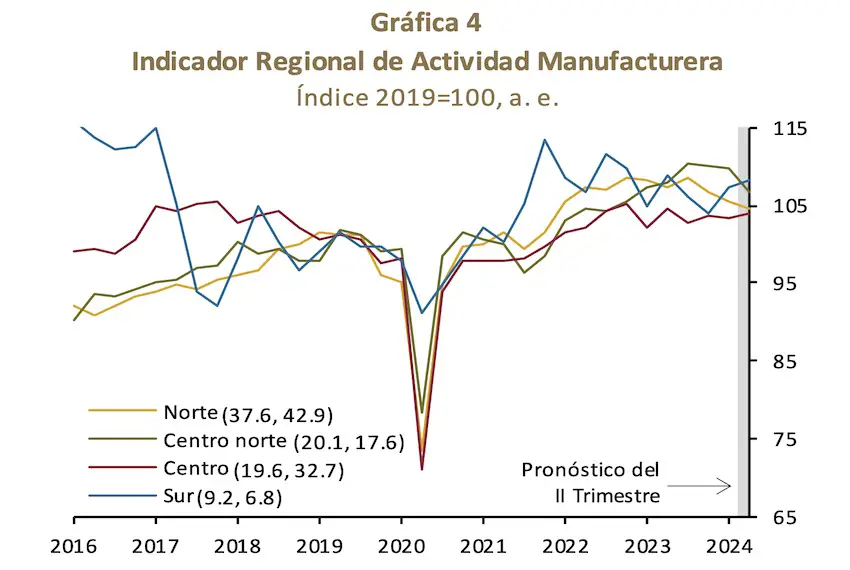

In its second quarter “regional economies” report, Banxico published data that showed that manufacturing activity in Mexico’s northern region — home to large numbers of maquiladoras, or export-oriented factories — declined 2.6% annually between April and June.

Manufacturing activity also decreased in the three other regions monitored by the central bank, but the contraction in the north was easily the biggest.

In Mexico’s central north, which includes Mexico’s industry-focused Bajío region, the year-over-year decline in Q2 was 1.2%, while the country’s central and southern regions recorded annual manufacturing activity contractions of 0.7% and 0.4%, respectively.

Compared to the first quarter of 2024, national manufacturing activity declined 0.2% between April and June, marking the fourth consecutive quarter-over-quarter contraction.

Banxico said that the manufacturing sector’s performance in the second quarter continued to be “weak.”

The slowdown in manufacturing activity came as Mexico seeks to bolster the sector by attracting foreign investment amid the nearshoring trend.

While numerous manufacturing companies have recently announced plans to establish plants here, the majority of foreign direct investment is currently coming from firms that already have a presence in Mexico.

Most manufacturing sub-sectors contracted in Q2

The Bank of Mexico reported that 14 of 20 manufacturing sub-sectors recorded contractions in the second quarter of 2024 compared to the previous three-month period.

Banxico said that the declines were the product of “weakness in production destined both for the internal and external market.”

The decline in the production of goods for export “could be related to the unfavorable performance” of the manufacturing sector in the United States given “the high integration of regional production chains,” the bank said.

Manufacturing output in the United States increased more than 3% annually in the second quarter, but Reuters reported that the sector “has at best been treading water as higher interest rates curb demand for goods and make capital investment challenging.”

The U.S. manufacturing sector declined 1.3% in the first quarter of the year.

Mexico’s strongest sector in Q2 was construction

Banxico noted that Mexico’s economy grew 1.1% annually in the second quarter of the year.

Mexico’s central region, which includes Mexico City, led the way, recording annual economic growth of 1.9%.

The economy of the northern region expanded 1%, while the central-north recorded growth of 1.2%.

Mexico’s southern region, which includes the country’s poorest states, recorded annual economic growth of just 0.3% between April and June.

The national construction sector grew 7.3% annually in the period, a strong result, but a significant slowdown from 13.3% annual growth in the first quarter of the year.

Private and public construction projects have recently contributed to strong construction sector growth.

The northern region recorded the largest construction sector growth in the second quarter, at 11.9% in annual terms.

The only other national sector monitored by Banxico that recorded annual growth between April and June was tourism. That sector grew 3.2%, up from 2.7% in the first quarter of the year.

In addition to manufacturing, activity in the mining, retail and agricultural sectors all declined in Q2. The annual contractions were 3.6% for mining, 0.7% for retail and 2.7% for agriculture.

Which regions are benefiting most from nearshoring?

Banxico’s Monthly Survey of Regional Business Activity, or EMAER, found that 12.9% of companies in Mexico with more than 100 employees recorded increases in production, sales or investment over the past year as a result of the nearshoring, or relocation, trend.

The figure — derived from reported increases in company production, sales or investment between July 2023 and July 2024 — is 3.6 percentage points higher than a year earlier.

Companies that operate in Mexico’s northern region were most likely to benefit from nearshoring, Banxico found.

Around one in six companies in the north — 16.9% — reported increases in production, sales or investment as a result of nearshoring. The percentage figure increased five points in the space of a year.

The percentage of companies that reported benefiting from nearshoring was 13.2% in the central north region of Mexico, 11.4% in central Mexico and 7.8% in the south. All those figures increased from a year earlier.

According to the Banxico report, the “perception” of Mexico’s business sector is that “the process of relocation is ongoing,” but the general opinion is that the full impact of the nearshoring trend will take some time to materialize.

Just over 41% of surveyed company representatives predicted that the greatest impact from nearshoring will be felt between 2026 and 2030. More than 31% believe that the nearshoring trend will make its biggest impact in 2025, while around 4% think that Mexico won’t reap the full rewards of the phenomenon until after 2030.

Exactly 23% of those surveyed believe that Mexico has already passed, or is currently at, its nearshoring peak.

Investment announcements for Mexico exceeded US $100 billion last year, and reached almost $50 billion in the first seven months of 2024, suggesting that Mexico has not yet reached its zenith as a nearshoring destination.

However, there is no guarantee that all announced projects will go ahead, and there are concerns that the new judicial reform, and other as-yet-unapproved constitutional bills, could have a significant negative impact on Mexico’s attractiveness as an investment destination.

JPMorgan Chase CEO Jamie Dimon said last November that Mexico “might be the number one opportunity” in the world for investors, while in December Thor Equities founder and chairman Joseph Sitt asserted that Mexico had become the “alternative” to China and represented a “golden” opportunity for investment.

But it remains to be seen whether Mexico will in fact capitalize on its nearshoring opportunity during the 2024-30 presidency of Claudia Sheinbaum, or whether factors such as government policy, insecurity, lack of energy and water, and insufficient infrastructure cause the country to fail to reach its much-touted potential.

More nearshoring-related reading

- Is nearshoring in Mexico going to end before it really begins?

- Which of Mexico’s states are best prepared for nearshoring?

- Could education be a barrier to Mexico’s nearshoring success?

- Why Mexico needs a nearshoring strategy

With reports from El Economista