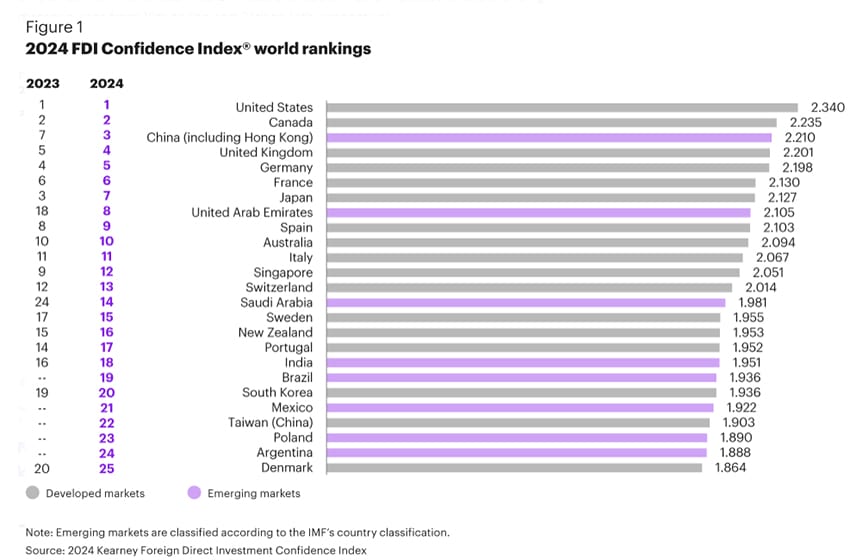

After a four-year hiatus, Mexico has reemerged as a top contender for foreign direct investment (FDI), appearing on Kearney’s 2024 FDI Confidence Index — placing 21st among 25 countries.

Mexico’s return to the list for the first time since 2019 comes amidst a global shift toward nearshoring, where companies are relocating operations closer to major markets such as the United States.

Mexico’s resurgence can be attributed to several factors: its geographical proximity to the U.S., a massive and growing consumer base, and a skilled labor pool that makes the nation of 131 million an attractive option for companies seeking to optimize their supply chains.

The Kearney report highlights Mexico as the leading beneficiary of manufacturing companies migrating from Asia, a trend known as “reshoring” — driven by a desire to reduce transportation costs, improve responsiveness to customer needs and minimize potential disruptions caused by geopolitical tensions.

According to Mexico’s Economy Ministry (SE), more than US $31.5 billion of FDI was pledged to Mexico during January, February and the first half of March — with $5.67 billion in the first 15 days of March alone. Those investment announcements, which came from 73 private companies, promised to generate 39,192 jobs.

While the United States remains the undisputed leader in FDI attraction for the 12th consecutive year, Mexico’s return to the top 25 signifies a renewed investor confidence in the nation’s economic potential. The report surveys investor sentiment regarding the next three years of FDI flows.

Notably, Mexico was sixth in the emerging market rankings, improving two spots from 2023, due to the growing appeal of Mexico’s burgeoning manufacturing sector and its ability to compete globally.

Mexico is behind established powerhouses such as China, Brazil and the United Arab Emirates on this list but ahead of Argentina, Thailand, Malaysia and Indonesia.

The Kearney Index also sheds light on broader trends shaping the global investment landscape. Technology, particularly artificial intelligence (AI), is rapidly becoming a key differentiator for investors.

Many Kearney respondents anticipate leveraging AI for various purposes, including investment decision-making, supply-chain management optimization and enhanced customer service experiences. Companies that effectively integrate AI into their operations are likely to gain a competitive edge in attracting foreign capital.

The Wall Street Journal reported Sunday that major U.S. tech companies have asked their Taiwanese manufacturing partners to increase production of AI-related hardware in Mexico in order to have access closer to home.

Kearney’s FDI Confidence Index paints a picture of a global investment environment brimming with both optimism and caution. While investors express confidence in the overall health of the global economy, they remain wary of risks such as geopolitical instability and a more restrictive regulatory environment.

The newspaper El Economista reported recently that Mexico was one of the world’s top 10 exporters in 2023, rising four places in the rankings to ninth.

And according to data presented by Omar Troncoso, a partner at Kearney México, Mexico was the 12th largest economy in the world in 2023, based on preliminary information from the International Monetary Fund (IMF).

With reports from PRNewswire, Expansión and El Economista