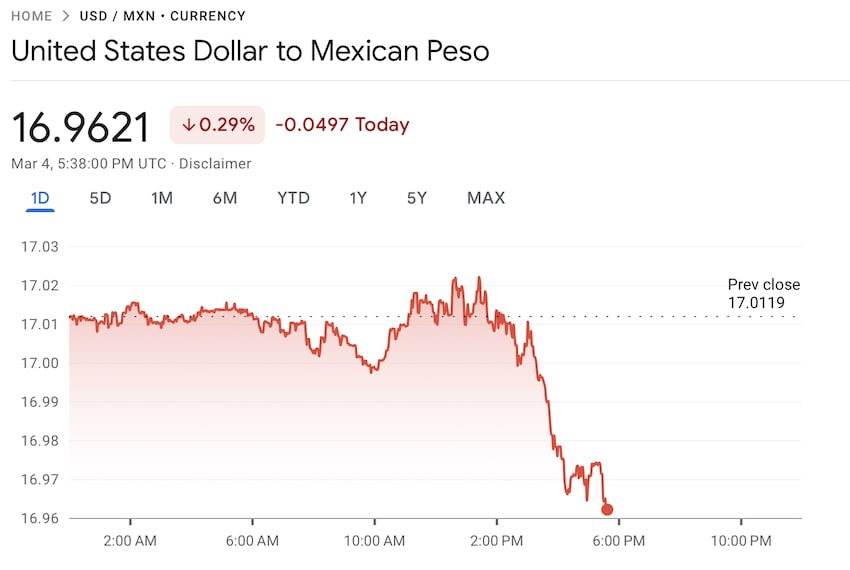

The Mexican peso made a good start to the new week, appreciating to below 17 to the US dollar for the first time this month.

Bloomberg data shows that the USD:MXN exchange rate was 16.96 at 11:40 a.m. Mexico City time.

The appreciation on Monday morning followed the peso’s improvement to 17.01 against the dollar at the close of markets last Friday after it traded at 17.09 a week earlier.

The business magazine Fortuna reported that analysts and foreign currency traders are attributing the peso’s positive performance to the expectation that the Bank of Mexico (Banxico) will be cautious in its approach to cutting interest rates.

The central bank’s key interest rate has remained at a record high of 11.25% since it was raised to that level almost a year ago.

The vast difference between Banxico’s rate and that of the United States Federal Reserve Bank (5.25%-5.5%) has benefited the peso, helping the currency appreciate around 13% against the greenback in 2023. Strong incoming flows of remittances and foreign investment also contributed to the peso’s positive performance last year.

The Bank of Mexico board will hold its next monetary policy meeting on March 21. A rate cut this month is seen as possible, but Banxico isn’t expected to aggressively lower rates this year. Interest rates are also expected to decline slowly in the United States, with an initial cut possible over the summer. However, some economists say the Fed might not make any cuts this year.

In Mexico, inflation declined in the first half of February after increases were recorded in November, December and January, but, at 4.45%, the headline rate is still above the central bank’s 3% target. Inflation data for the whole month of February is due to be published this Thursday, March 7.

In its most recent monetary policy statement, Banxico said it would “thoroughly monitor inflationary pressures as well as all factors that have an incidence on the foreseen path for inflation and its expectations.”

“In the next monetary policy meetings, … [the board] will assess, depending on available information, the possibility of adjusting the reference rate. It will take into account the progress in the inflation outlook and the challenges that prevail,” the bank added.

An interest rate cut in Mexico before one is made in the United States would obviously narrow the differential in the prevailing rates in the two countries and would likely benefit the greenback.

However, a range of other factors influence the value of currencies. Therefore, it is no easy task to predict how the USD:MXN rate will behave this year, especially considering that it is an election year in both Mexico and the United States and there is a climate of political uncertainty in the two countries. Donald Trump’s victory in a single primary contest earlier this year was enough to inflict some pain on the peso, although the currency has strengthened since then, despite the former U.S. president’s unrelenting march toward the Republican Party nomination.

In a survey report published late last year, Citibanamex said that the consensus forecast of 33 banks, brokerages and research organizations was that the USD:MXN exchange rate would rise to 18.65 at the end of 2024.

Mexico News Daily