Chinese investment in Mexico has increased significantly in recent years, but the East Asian nation is still a long way off matching the outlays of countries such as the United States and Spain.

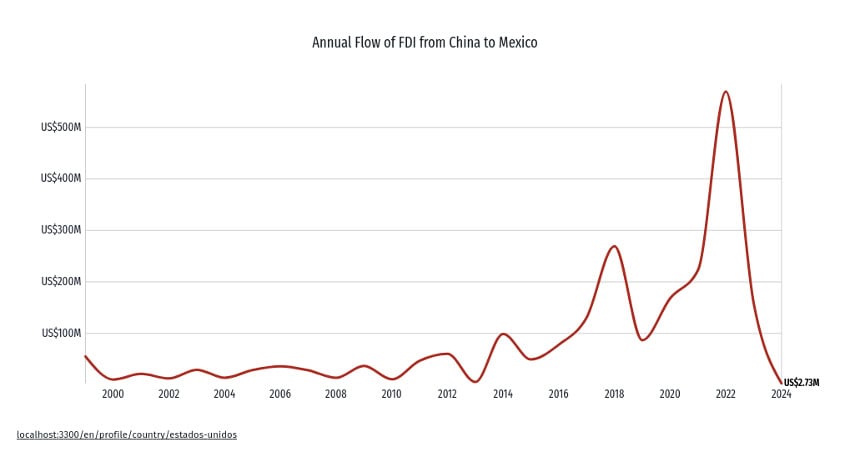

Economy Ministry (SE) data shows that Chinese foreign direct investment (FDI) in Mexico totaled US $2.073 billion between 2006 and March 2024. Just over 55% of that amount was invested in the country since 2020.

Chinese investment in Mexico peaked in 2022 at $569.7 million, a figure that accounts for 27% of the country’s total FDI in Mexico over the past 18 years.

The amount represented an increase of 335% compared to 2017, 845% compared to 2012, and a whopping 4,534% compared to 20 years earlier in 2002.

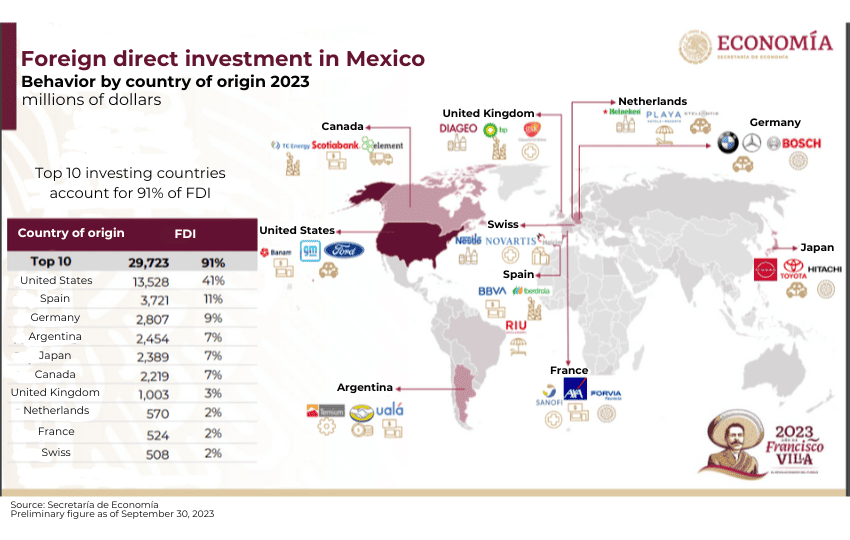

China was among the top 10 investors in Mexico in 2022, but its total investment was dwarfed by that of the United States, whose FDI in Mexico totaled $20.2 billion that year, according to the SE.

China was not among the top 10 investors in Mexico last year, with its FDI falling to $159 million, nor was it among the top 10 in the first quarter of 2024.

China’s total investment in Mexico between 2006 and the first quarter of 2024 represents just a small fraction of the FDI of countries such as the United States and Spain.

The Reforma newspaper reported Tuesday that the United States’ FDI in Mexico between 2006 and the first quarter of this year was just over $239 billion, while Spain’s outlay during the same period was just under $57.5 billion.

Why does the data matter?

There has been a lot of focus on Chinese investment in Mexico lately, with several media outlets, including the BBC and The Economist, reporting that Chinese companies are using Mexico as a “backdoor” to the United States as products made here can be exported tariff-free to the U.S.

Increasing attention is also being given to the increase in Chinese exports to Mexico, and the proliferation of Chinese-operated wholesale establishments in downtown Mexico City.

The data on Chinese investment in Mexico is important as it indicates that Chinese companies have not yet collectively established an overly significant presence in the Mexican economy, despite claims — or impressions — to the contrary. Companies from the United States, Canada, Spain, Germany and various other countries have invested much more in Mexico than Chinese firms.

Jorge Guajardo, a former Mexican ambassador to China and a close observer of Chinese investment in Mexico, said on X that the data showing much greater investment in Mexico by the U.S. and Spain than China provides “context for those who claim China is using Mexico as a manufacturing base to enter the U.S.”

Does the data reflect all Chinese FDI in Mexico?

As Mexico News Daily reported in late 2023, it appears that not all Chinese money that flows into Mexico is counted as such.

The reason, according to Enrique Dussel Peters, an economist and coordinator of the Center for Chinese-Mexican Studies (Cechimex) at the National Autonomous University, is that some Chinese investment comes into Mexico via United States subsidiaries of Chinese companies.

The FDI inflow is thus recorded as coming from the United States, when for all intents and purposes the money came from China.

According to Cechimex, Chinese investment in Mexico between 2001 and late 2022 totaled $17 billion, more than six times higher than the amount recorded by the SE between 1999 and March 2024.

China is not yet a top investor in Mexico, but it could be soon

While China is not yet close to matching the outlay of the top investor nations in Mexico, the situation could change — if Chinese companies act on their investment announcements.

According to the SE, Chinese companies made investment announcements totaling $13.19 billion last year. China was second in the “expected investment” rankings in 2023, behind only the United States.

Two Chinese companies, LGMG and Jetour, made announcements totaling $8 billion last year, or over 60% of the total expected FDI for China. As the $13 billion has only been announced, rather than invested, it has not yet shown up in the Economy Ministry’s FDI data.

This year, leading electric vehicle manufacturer BYD is among the Chinese companies that have committed to invest in Mexico. It has not yet announced how much it intends to invest in a plant in Mexico or where it will be located, but the outlay on a facility that is slated to create 10,000 jobs would be significant.

If LGMG, Jetour, BYD and other companies go ahead with their announced projects — which is no certainty — China could shoot up the FDI rankings for Mexico in the near future.

One potential barrier to future Chinese investment in Mexico is Mexican government opposition to it.

While Mexico is currently welcoming Chinese investment, Finance Minister Rogelio Ramírez de la O said last Saturday that the government is “considering” changing its investment policy with regard to China. Without providing specific details, he suggested that Mexico could seek to prevent or limit Chinese investment in some sectors.

With reports from Reforma