Another prominent United States business figure has given a glowing endorsement of Mexico as an investment destination.

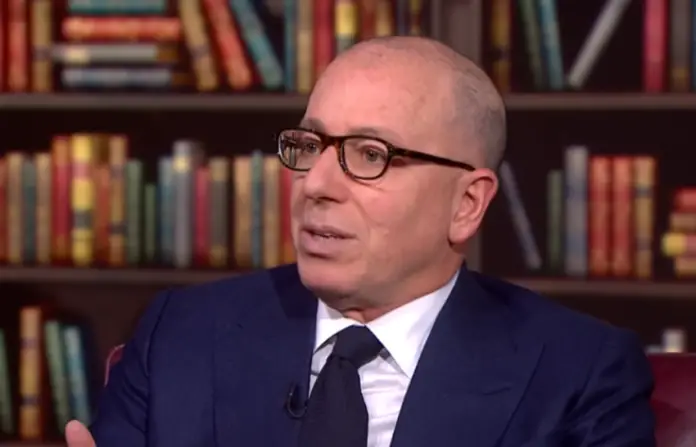

JPMorgan Chase CEO Jamie Dimon said in November that Mexico “might be the number one opportunity” in the world for investors, while earlier this month Thor Equities founder and Chairman Joseph Sitt asserted that Mexico has become the “alternative” to China and currently represents a “golden” opportunity for investment.

Sitt also highlighted Mexico’s “sophisticated” advanced manufacturing capacity, expressed optimism about a future Mexican government led by either of Claudia Sheinbaum or Xóchitl Gálvez and acknowledged that the country has become a global cultural force.

In an interview with Bloomberg Television, the Thor chairman said that the New York-based real estate development and investment company he leads is one of the “top two” or “top three” developers in Mexico, explaining that it has interests in areas including retail, hospitality, manufacturing and real estate.

Asked why Thor Equities — which has a Mexican offshoot called Thor Urbana — was in Mexico, the man who has been described as “America’s luxury retail property king” cited “opportunity, growth and alternative” before asserting that “Mexico is becoming quite the answer to some of the United States’ economic problems.”

“And by being that solution it’s been wonderful for them,” said Sitt, who later in the interview mentioned the strong flows of foreign direct investment Mexico has seen this year.

“… As a country, we see the world sort of bifurcating, multipolar, conflict. Mexico is a great solution; it’s right here in our backyard, it’s easy, labor is actually cheaper than labor is in China, the people are hardworking, they’re industrious, … the logistics for a container ship is free relative to shipping it from China, and so [Mexico has] really become the Chinese alternative,” he said.

Sitt acknowledged the growing strength of Mexico’s auto industry before highlighting the progress that has been made in advanced manufacturing capacity across sectors.

“Mexico sometimes is thought of as a little bit of a backwards manufacturing country, but they’ve gotten so much more sophisticated, shockingly so to some people, not to myself, but when you look at medical products, EV, battery manufacturing, Mexico’s right up there, just as good if not better than building in China,” he said.

Bloomberg presenter David Westin acknowledged that Sitt had described “a big investment opportunity in Mexico” before putting the following question to the Thor chairman:

“Typically when there is an opportunity money rushes in, capital rushes in and it becomes fully priced. Where are we in that cycle? How close are we to fully pricing the assets in Mexico?”

“Excellent question,” Sitt responded.

“Often people generalize by the country but you’ve got to also look at the specifics, meaning by the asset classes. For example nearshoring, you had 120 companies announce investments in Mexico … [in the] first half of this year, about US $29 billion in [foreign] investment, 41% increase from last year. Based upon the early research, it’s looking like next year is going to double on that,” he said.

“So I would say from the industrial opportunity, I think we’re in the very, very early innings of it, probably the earliest innings amongst the different food groups. … We think [Mexico] is another one of those golden opportunities. … We’re just in the beginning of the second inning with a lot of runway and those investors that act quickly, now, to mine that opportunity, will get that benefit. If they wait … three years or four years or five years, then it starts getting priced in.”

Asked about the Mexican political situation and its impact on investors, Sitt said that AMLO, as President López Obrador is best known, “scared the beejeebies out of local players, and candidly myself” when “he was going through his election cycle” prior to the 2018 election he comprehensively won.

“AMLO then came in and he sounded good, he was a good hearer of what people were saying but wasn’t a good listener, I’m sorry to say. And so I really think that Mexico did well in spite of itself,” he said.

“Now, the politics is much better. Either way we’re getting a woman for the first time as the president of Mexico. It’ll either be Claudia Sheinbaum or Xóchitl Gálvez, both of them pro-business, listeners, touching their communities and really caring about their constituents at all levels and not just considering rhetoric to be the answer,” Sitt said.

Earlier in the interview, he spoke about Mexico’s “local specialty assets” — avocados, tequila and beer — and how popular Mexican culture has become.

“We know it as, you know, going out and having that drink of beer and having the dip and the tequila et cetera, et cetera, but it really is a product that’s been growing. I mean if you think of tequila, 30 years ago did you really go to a bar and hear a friend order a tequila? Not really. And so Mexican culture has gone global, it’s gone viral, sort of what happened to sushi 40 or 50 years ago happened to Mexico,” Sitt said.

Mexico News Daily