As we all try to figure out how to use some version of GPT to answer emails, Nano Banana to make our Google Slides look prettier and Grok to turn photos into videos — or answer questionable political questions on X — it’s easy to forget that the AI conversation tied to global power and national security is far more complex.

Beneath the memes, prompts and productivity hacks lies a serious geopolitical race. And in that space, the U.S.-Mexico relationship may be one of the most important — and underappreciated — dynamics shaping trade and economic policy in the years ahead.

At its core, AI leadership isn’t just about algorithms. It’s about hardware, energy, data, talent, resilience and national security.

Models don’t train themselves in the cloud — they require massive computing power, physical servers, advanced chips, secure supply chains and uninterrupted infrastructure. In that sense, AI looks a lot more like manufacturing than software. And that’s where North America — and especially Mexico — enters the picture. The USMCA’s digital trade framework is becoming a national security tool, not just a trade one — governing data flows, infrastructure and trust in ways that directly shape AI competitiveness (Inter-American Dialogue).

As tensions with China persist and export controls on advanced chips tighten, the United States faces a simple challenge: how to scale AI infrastructure fast, securely and close to home. This is a race where the digital world is moving more quickly than the physical one. AI leadership ultimately rests on semiconductors, and today roughly three-quarters of global chip manufacturing capacity remains concentrated in East Asia, with advanced production highly exposed to geopolitical risk (US-Mexico Foundation). (No need to revisit what happened during COVID).

One concrete example: Mexico is now home to major investments in AI server and “superchip” assembly. Nvidia’s next-generation GB200 servers are being assembled in Jalisco through Foxconn, alongside a growing ecosystem of suppliers relocating from Asia. These facilities aren’t designed for the Mexican market — they’re built to serve North American strategic needs. This is nearshoring not as a buzzword, but as an AI supply-chain strategy. To understand why infrastructure location matters so much, it helps to look at where the physical backbone of the digital economy actually lives.

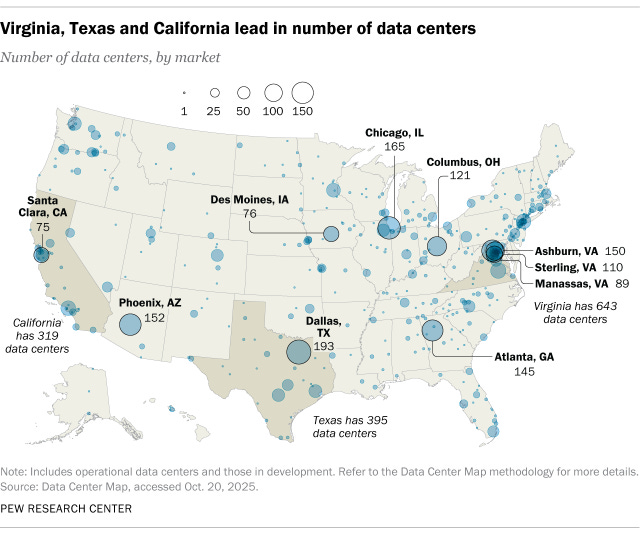

AI doesn’t live in the cloud — it lives in data centers. And those data centers are highly concentrated geographically, making location, energy and connectivity strategic assets.

Hardware, however, is only half the story. AI also runs on data centers — lots of them. Mexico is rapidly becoming an extension of the North American digital backbone. Multibillion-dollar investments from Microsoft, AWS and others are turning cities like Querétaro into critical nodes for cloud and AI workloads. Enabled by USMCA digital trade rules, these data centers operate within compatible regulatory and privacy frameworks, allowing U.S. firms to expand capacity, improve latency and build redundancy without leaving the region.

This distributed infrastructure matters for resilience. AI systems can’t afford downtime.

In scenarios ranging from cyberattacks to natural disasters or energy stress, having computing capacity spread across the continent strengthens continuity. Mexico and Canada aren’t alternatives to the United States — they are fail-safes. And Mexico’s comparative advantage in this ecosystem isn’t about replicating advanced chip fabs, but about strengthening the assembly, testing, packaging and integration layers that make AI hardware scalable and resilient across North America (U.S.-Mexico Foundation). This isn’t happening by accident. Mexico’s next phase of industrial and digital policy is explicitly aligned with this opportunity.

CFE opens 269-MW combined cycle power plant in Querétaro to boost Bajío grid

Mexico’s industrial and digital infrastructure plans — including data centers, energy, and advanced manufacturing — are increasingly aligned with North America’s AI and nearshoring strategy.

Then there’s talent. AI leadership ultimately depends on people, not just machines. Mexico produces thousands of engineers and computer science graduates every year, many already embedded in North American firms and research ecosystems. Mexican universities graduate over 130,000 engineers annually across degree levels, along with nearly 3,000 master’s graduates in computer science or related fields — the highest number in Latin America. Talent mobility under the USMCA, combined with shared standards and regulatory coordination, accelerates innovation while keeping critical capabilities inside the region.

Seen through this lens, AI becomes a familiar story. Just like manufacturing, trade and energy, the United States doesn’t need to “do it all alone.” It needs a trusted, integrated regional system that lowers risk, increases scale and preserves strategic autonomy. Mexico is not a competitor in the AI race — it is an enabler.

(Just as a footnote, AI related to physical security enforcement, arms and potential war is a huuuge topic, of which I’m not capable of writing about, but keep that in mind as well.)

AI dominance won’t be decided by who writes the best prompt. It will be decided by who controls the full stack: chips, servers, energy, data, talent and trust. The upcoming 2026 USMCA review isn’t just a procedural milestone — it’s a narrow strategic window to lock in North America’s AI advantage before other models define the rules instead (Inter-American Dialogue).

In AI, just like in trade, the future isn’t about decoupling from your closest partners.

It’s about building with them.

Catch up on parts 1-4 of Could Mexico make America great again? here:

- Part 1: An introduction

- Part 2: A primer on China

- Part 3: Zeroing in on the demographics

- Part 4: About that trade deficit

Pedro Casas Alatriste is the Executive Vice President and CEO of the American Chamber of Commerce of Mexico (AmCham). Previously, he has been the Director of Research and Public Policy at the US-Mexico Foundation in Washington, D.C. and the Coordinator of International Affairs at the Business Coordinating Council (CCE). He has also served as a consultant to the Inter-American Development Bank.