Mexico’s northeast — made up of the states of Coahuila, Nuevo León, San Luis Potosí and Tamaulipas — is the country’s most competitive region, according to the Mexican Institute for Competitiveness (IMCO).

On Monday, IMCO, a Mexico City-based think tank, published its first Regional Competitiveness Index (ICR), which ranks six regions of Mexico based on their capacity to attract and retain investment and attract and retain talent.

In a statement, IMCO said that the index “understands competitiveness as a regional phenomenon, where the performance of one state influences its neighbors.”

“… The index results confirm that competitiveness is not an isolated phenomenon: advances — or setbacks — in one entity can have spillover effects on its neighbors.”

IMCO used a range of data to evaluate the six regions’ performance on 40 variables across four sub-indexes: attraction of investment, attraction of talent, retention of investment and retention of talent. It consequently determined that Mexico’s most competitive region is the northeast, followed by the northwest.

The Bajío region ranks third, followed by central Mexico, the Maya region and the Isthmus region.

IMCO’s publication of its inaugural ICR in early 2026 comes after economic growth in Mexico slowed significantly in 2025.

The index serves as additional evidence that economic and social development is significantly more advanced in northern Mexico than in the country’s south. The previous federal government, and the current one, have been seeking to remedy that situation, including by building large-scale infrastructure projects in southern and southeastern Mexico, such as the Maya Train railroad and the Olmeca Refinery on the Tabasco coast.

However, IMCO’s ICR and other indicators, such as data on poverty reduction across Mexico, show that there is plenty of work still to be done.

1. The northeast

The northeast ranked first among the six regions in three of the four sub-indexes, taking the top spot in attraction of investment; attraction of talent; and retention of talent.

Its ICR score was 68.18 out of 100, which equates to “high competitiveness,” according to IMCO.

“This performance reflects an integrated ecosystem, where [the northeast region’s] infrastructure, labor market, operational certainty, and productivity reinforce each other and generate a competitive environment,” IMCO said.

Valeria Moy, the think tank’s director, said that the states of the northeast don’t compete with each other or function in an “isolated” way, but rather collaborate.

She said that the northeast region’s ranking on the ICR positions it as “the most attractive [region] for the establishment, operation, and expansion of companies,” and the most attractive region for “qualified human capital.”

According to IMCO’s assessment of the 40 variables across the four sub-indexes, the northeast ranks first among the six regions in 17 of them. They include:

- Economic diversification.

- The contribution of exports to regional GDP.

- Industrial parks.

- GDP per capita.

- Homes with running water.

- Formal sector job growth.

- Investment in water infrastructure.

- Perceptions of corruption (i.e. it is perceived to have the lowest levels of corruption).

- Perceptions of security.

- Access to health care.

- Labor productivity.

- Highway robberies (i.e. the northeast has the lowest rate).

- Employment informality (i.e. the northeast has the lowest percentage of informal sector workers).

The northeast didn’t rank last among the six regions in any of the 40 variables.

2. The northwest

The northwest region is made up of the states of Baja California, Baja California Sur, Chihuahua, Durango, Sinaloa, Sonora and Zacatecas. It ranked second in the attraction of investment and retention of talent, and third in the other two sub-indexes.

Its ICR score was 62.33, which equates to “medium-high competitiveness.”

The northwest ranked first on three of the 40 variables assessed by IMCO, taking the top spot for electricity prices, and natural gas prices, and for having the lowest percentage of residents with incomes below the poverty line.

The northwest ranked last among the six regions for expenditure by companies on security; energy intensity (electricity use-to-GDP ratio); homicides (i.e., it has the highest rate); respiratory morbidity; and changes (i.e., increases) to housing prices.

3. The Bajío

In IMCO’s ICR, the Bajío region is made up of the states of Aguascalientes, Colima, Guanajuato, Jalisco, Querétaro, Michoacán and Nayarit.

It ranked first in the retention of investment sub-index, third in attraction of investment and fourth in both attraction of talent and retention of talent.

Its ICR score was 54.22, which equates to “medium-high competitiveness.”

The Bajío ranked first on three of the 40 variables, taking the top spot for per capita applications for patents; its unreported crime rate; and for respiratory morbidity (i.e., it has the lowest per capita rate of respiratory diseases).

The Bajío ranked last on just one variable — “income gap by gender.”

4. Central Mexico

The “Centro,” or Central Mexico, region is made up of Mexico City, México state, Hidalgo and Morelos. It ranked second for attraction of talent, third for retention of talent, fourth for attraction of investment and sixth (last) for retention of investment.

Its ICR score was 49.11, which equates to “medium-low competitiveness.”

Although it only ranked fourth among the six regions, Central Mexico took top spot in eight of the 40 variables.

Centro ranked first for:

- Foreign direct investment.

- Educational attainment.

- Educational coverage.

- The percentage of the population with higher education qualifications.

- Skilled labor.

- Energy intensity.

- Homicides (i.e. it has the lowest rate, according to IMCO, even though México state and Morelos are among Mexico’s 10 most violent states in terms of total murders).

- Changes to housing prices.

5. The Maya region

The Maya region is made up of the states of Campeche, Chiapas, Quintana Roo, Tabasco and Yucatán. It ranked fourth for retention of investment and fifth in each of the three other sub-indexes.

Its ICR score was 34.19, which equates to “medium-low competitiveness.”

The Maya region ranked first for “average age” (i.e. its residents are the youngest); strikes (i.e. it has the fewest); gender income gap; crime (i.e. it has the lowest rate); coverage of childcare centers; and infant mortality (i.e. it has the lowest rate).

It ranked last for economic diversification; industrial parks; patents; formal sector job growth; economic participation; electricity prices; incoming population flows; and the percentage of residents with incomes below the poverty line (i.e. it has the highest rate).

6. The Isthmus region

For IMCO’s ICR, the Istmo, or Isthmus, region (named after the Isthmus of Tehuantepec) is made up of the states of Guerrero, Oaxaca, Puebla, Tlaxcala and Veracruz. It ranked fifth for retention of investment and sixth in the three other sub-indexes.

Its ICR score was 26.66, which equates to “low competitiveness.”

The Isthmus region ranked first for growth in the number of “economic units” with more than 50 employees; kilometers of highways per 1 billion pesos of GDP; and expenditure on security by companies.

It ranked last in 15 variables, including:

- Foreign direct investment.

- GDP per capita.

- Homes with running water.

- Educational attainment.

- Skilled labor.

- Investment in water infrastructure.

- Labor productivity.

Observations and proposals from IMCO

IMCO identified a number of “obstacles” that hinder regional competitiveness, including high levels of employment informality (more than half of Mexico’s workers are employed in the informal sector), insecurity and “high wage inequality,” which has a negative impact on talent retention.

IMCO described its Regional Competitiveness Index as a “key tool for guiding public policy, strengthening regional cooperation, and unlocking the collective value of the country’s regions.”

In that context, it offered proposals to the private sector, to state governments, and to the federal government.

For the private sector:

- Establish “regional training hubs” for the training of workers at a “regional scale.” Such hubs, IMCO said, could be established by consortia of companies and industrial parks. The establishment of the hubs would “strengthen talent retention through coordinated investment in human capital,” and allow training costs to be shared, the think tank said.

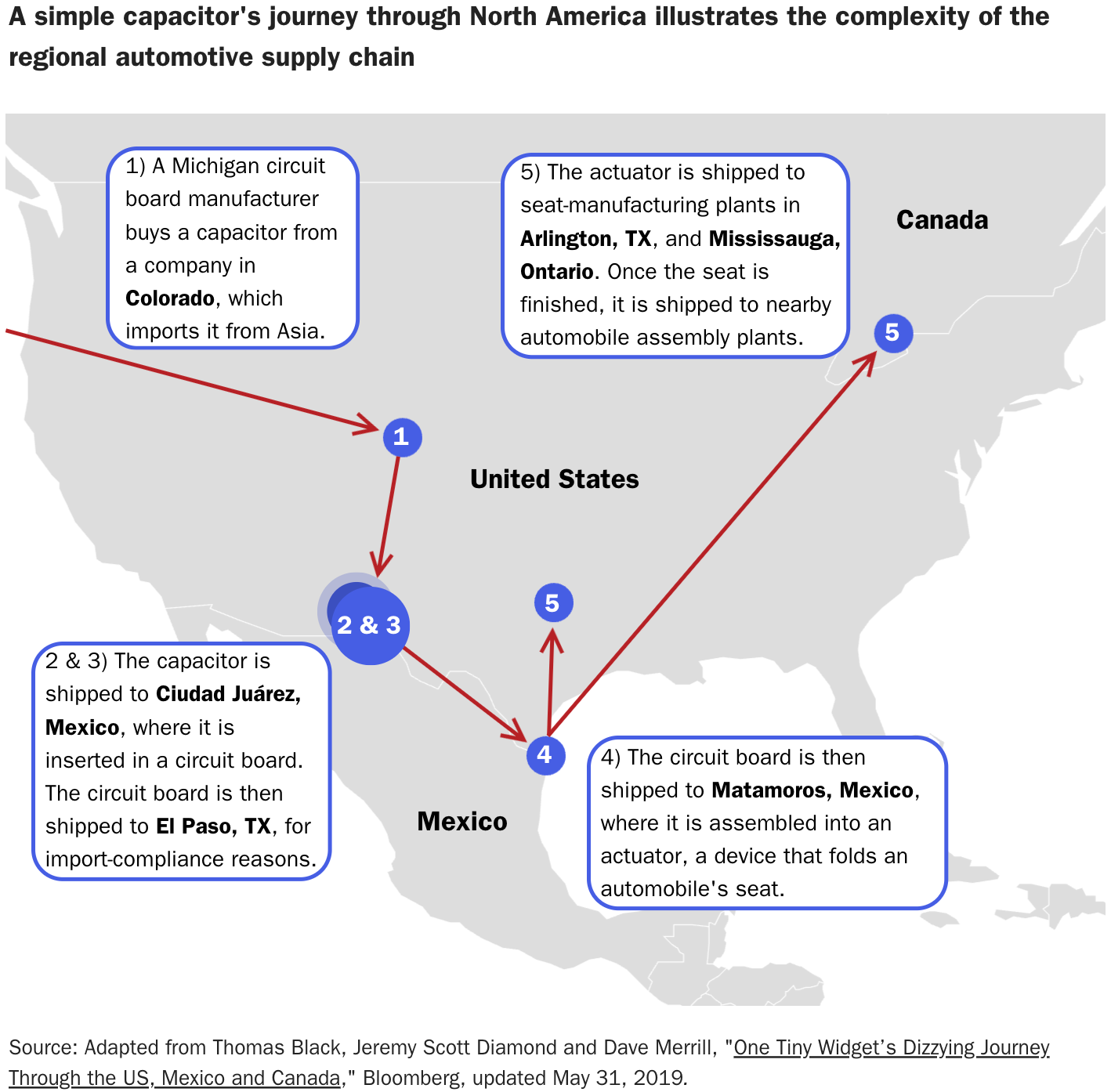

- Design operational strategies with a “regional focus,” including by “structuring supply chains, the location of suppliers and investment decisions” in a way that considers the region as “one single ecosystem.”

- Maximizing the return on capital invested by “diversifying toward emerging sub-sectors” that are experiencing “rapid growth.” In addition, IMCO said that private companies should “align” their investment portfolios with the federal government’s Plan México initiative in order to take advantage of federal incentives and “co-investment mechanisms in strategic sectors such as energy and logistics.”

For state governments:

- State governments in each region should “align agendas” in order to “compete as a region,” rather than as “isolated” entities, IMCO said.

- They should “consolidate common priorities,” such as reducing informality, improving access to health care and guaranteeing water supply in urban areas.

- They should seek to reduce dependence on federal support and “strengthen regional resilience.”

For the federal government:

- The federal government should “orient programs and incentives” toward the development of regional projects.

- Federal support for “nearshoring, logistics and technical training should prioritize projects that connect leading states [in competitiveness] with lagging entities.”

As part of Plan México, the federal government is already developing new “Economic Development Hubs For Well-Being, located within larger industrial corridors focused on specific sectors. Each of the corridors stretches across three or more states, and all focus on sectors including renewable energy, manufacturing, logistics, agriculture and tourism.

By Mexico News Daily chief staff writer Peter Davies (peter.davies@mexiconewsdaily.com)