On the very first day of his second term as U.S. president, Donald Trump was asked whether he would consider “ordering U.S. special forces into Mexico” to “take out” drug cartels.

“Could happen. Stranger things have happened,” Trump responded.

In May last year, President Claudia Sheinbaum revealed that she had rejected an offer from Trump to send the U.S. Army into Mexico to combat cartels, while in November NBC News reported that the Trump administration had begun planning a “potential mission” on Mexican soil that would target cartels, including with drone strikes.

Now, The New York Times is reporting that the United States is “intensifying pressure” on Mexico “to allow U.S. military forces to conduct joint operations to dismantle fentanyl labs inside the country.”

Published on Thursday, the Times’ report quotes U.S. officials who spoke with the newspaper “on condition of anonymity to discuss sensitive diplomatic issues and military planning.”

Its publication comes two days after Sheinbaum spoke by telephone with Trump, a call she requested in light of the U.S. president’s declaration last Thursday that the United States would begin hitting cartels on land.

The Mexican president subsequently said that Trump told her that the United States could provide additional assistance to combat cartels if Mexico requested such help. Sheinbaum — a staunch defender of Mexican sovereignty and an ardent opponent of any kind of U.S. intervention in Mexico — told her counterpart that U.S. “boots on the ground” help wouldn’t be necessary.

The president — whose government has significantly ramped up the fight against organized crime over the past 15 months — also said on Monday that a U.S. military action in Mexico could be ruled out.

NYT: US officials want American forces to take part in Mexican Army raids

Citing its sources, the Times reported that “U.S. officials want American forces — either Special Operation troops or C.I.A. officers — to accompany Mexican soldiers on raids on suspected fentanyl labs” in Mexico.

Under the U.S. proposal, Mexican troops would lead the raids and make “key decisions,” while U.S. forces would support them, providing intelligence and advice, according to the Times’ reporting.

The newspaper noted that “such joint operations would be a significant expansion of the United States’ role in Mexico, and one that the Mexican government has so far adamantly opposed.”

The Times, again citing its U.S. government sources, wrote that the United States’ joint operations proposal “was first raised early last year and then largely dropped.”

“But the request was renewed after U.S. forces captured President Nicolás Maduro of Venezuela on Jan. 3 and has involved the highest levels of government, including the White House, according to multiple officials.”

Given Sheinbaum’s staunch defense of Mexican sovereignty and her repeated assertions that U.S. forces won’t be allowed to come into Mexico to combat the country’s notorious drug cartels, it would appear extremely unlikely that she would consent to the Trump administration’s request, no matter how intense the pressure becomes.

In addition to the president’s personal opposition, the United States’ “proposal for joint operations also runs up against recent Mexican laws that restrict foreign troops on Mexican soil, including a constitutional amendment passed last year,” the Times wrote.

Sheinbaum frequently stresses that her administration is willing to collaborate and cooperate with the U.S. government on security issues, but will not accept subordination or any violation of Mexican sovereignty. Indeed security cooperation between Mexico and the United States is premised on “the principles of reciprocity, respect for sovereignty and territorial integrity, shared and differentiated responsibility, as well as mutual trust,” according to a joint statement issued in September.

Security Minister Omar García Harfuch told the Times last month that Mexico has “highly trained army units and special forces,” and in light of that dismissed the need for U.S. forces in Mexican territory.

“What we need is information,” he said.

NYT: US advisers are already in military command posts in Mexico

While the Mexican government has not consented to joint operations in Mexico, Mexican officials this month “offered counter proposals,” including “increased information sharing and for the United States to play a greater role inside command centers,” the Times reported, citing “a person familiar with the matter.”

The newspaper wrote that “U.S. advisers are already in Mexican military command posts, according to American officials, sharing intelligence to help Mexican forces in their antidrug operations.”

The Times added that “Mexican officials are under pressure to reach an agreement, as some American officials would like to see the U.S. military or C.I.A. conduct drone strikes against suspected drug labs.”

“… But fentanyl labs are notoriously difficult to find and destroy,” the newspaper wrote, citing U.S. officials.

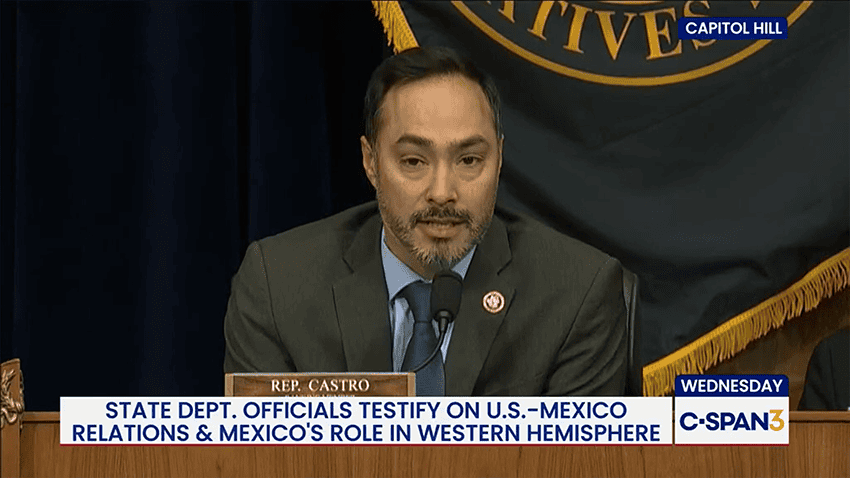

US Democrats introduce bill aimed at stopping unauthorized US military force in Mexico

Democrats in the United States are standing up to Trump’s military intervention in Venezuela and potential unilateral action in Mexico.

On Wednesday, three Democratic Party lawmakers, Congressman Joaquin Castro, Congresswoman Sara Jacobs and Congressman Greg Stanton, introduced the “No Unauthorized War in Mexico Act” to the U.S. House of Representatives.

The legislation advocates a “prohibition on use of force in or against Mexico” unless the U.S. Congress has “declared war on Mexico” or “enacted specific statutory authorization for such use of military force after the date of the enactment of this Act.”

If enacted, the legislation would “prohibit taxpayer funds from being used for an unauthorized war in Mexico,” according to a statement issued by Castro.

“Launching the United States into another unnecessary — and unauthorized — war in Latin America is a destabilizing move that will come back to haunt the nation,” Castro said.

“My constituents in San Antonio don’t want the U.S. to spend billions in another war that risks destabilizing the region, mass migration, and human rights abuses. My legislation, the No Unauthorized War in Mexico Act, would protect our relationship with a close ally and prevent wasting taxpayer dollars on military force in Mexico,” he said.

While its extremely unlikely that the bill will be approved by the Republican-dominated lower house of Congress, it serves as a warning to, and rebuke of, the Trump administration, and adds to the public debate over its intentions in Mexico.

The introduction of the bill came five days after Castro, Stanton and 70 other House Democrats wrote to U.S. Secretary of State Marco Rubio to express their opposition to “the unauthorized use of military force in Venezuela and threats from the President and administration officials alluding to U.S. military action inside Mexico without Mexico’s consent and without congressional authorization.”

“… Unilateral military action against Mexico would be disastrous,” they wrote before pointing out that “Mexico is America’s number one trading partner and critically important security partner with whom we share longstanding familial and border connections.”

“Under President Claudia Sheinbaum, Mexico has dramatically increased its cooperation with the United States. Any unilateral military action would violate Mexico’s sovereignty, and tarnish the new era of cooperation that … Sheinbaum has ushered in.”

With reports from The New York Times, La Jornada and San Antonio Express News