Los Cabos has been consciously rebranded as a luxury destination in recent years. It’s a process that dates back to hurricane recovery a decade ago, following the devastating category-4 storm Odile in 2014. But despite the luxury renovations and influx of high-end hospitality brands in the years since, from Nobu and Four Seasons to Ritz-Carlton and Waldorf Astoria, it is still possible to find budget-friendly hotel rooms in Los Cabos.

The price of the average hotel room has indeed been steadily rising. By the end of 2016, it was still just $206. But that figure has increased by over 150% in the eight years since. After 2022 it had more than doubled to $417. That trend has only continued through the start of 2024. The average daily rate has now climbed to a whopping $517, indicating an uptick of 23% in the last year alone.

Of course, it bears noting that these numbers are skewed by the swankiest of the high-end luxury resorts, where room rates are upwards of $1000 a night. However, only 3,000 of the 18,000 rooms currently in inventory for the municipality are categorized as luxury level—the rest range from intermediate levels of pampering comfort to refreshingly affordable, if not downright cheap. For our purposes, we’ll define the latter category as under $100 a night.

Fortunately, rooms are still available in this low price range, although less than there used to be.

The Best Budget-Friendly Hotels in 2024

An example of this dwindling inventory would be the Hotel Mar de Cortez, for nearly 50 years the cynosure of budget-friendly accommodations in Cabo San Lucas. Sadly, this downtown landmark closed in 2021 amid the coronavirus pandemic.

The Land’s End city remains the best place to find affordable hotel rooms, however, with most conveniently located near the Marina – amid downtown shopping and dining – but within walking distance of Playa El Médano, the most popular beach in the area. Boutique hotel Siesta Suites, for example, is only a stone’s throw from the Marina, on the one-block-long street Calle Zapata, and its most affordable rooms start at US $75 per night. Suites with kitchenettes are US $85 and its penthouse, with wraparound city views from its enormous terrace, is only US $105.

That’s not the cheapest hotel in Los Cabos by any means. That title likely belongs to Cabo Cush, where rates start at 800 pesos (US $48 at the current exchange rate) for a standard room with a king-sized bed and twin, as well as basic amenities like air-conditioning, cable television, and even free phone calls to the U.S. and Canada. Yes, weekly rates are available, too, and as a bonus, beloved comfort food favorite El Pollo de Oro is only two blocks away.

But there are several other good US $100 or less options, including Cabo Inn Hotel, and the boutique gem Los Milagros. Affordable accommodations of this type are much rarer in San José del Cabo. and along the Los Cabos municipality’s scenic East Cape. Baja California Sur’s capital city of La Paz, a two-hour drive from Los Cabos, has more – the most notable being Hotel Pekin, a lodging above a Chinese restaurant that overlooks the malecón.

What Amenities Can You Reasonably Expect?

Luxury hotels in Los Cabos typically provide onsite restaurants, wellness spas, fitness facilities, and often private roped-off beach areas. Many mid-range properties, meanwhile, may also offer all-inclusive plans that roll many food and beverage costs into the room rate. None of these options, notably, are common with budget-friendly hotels.

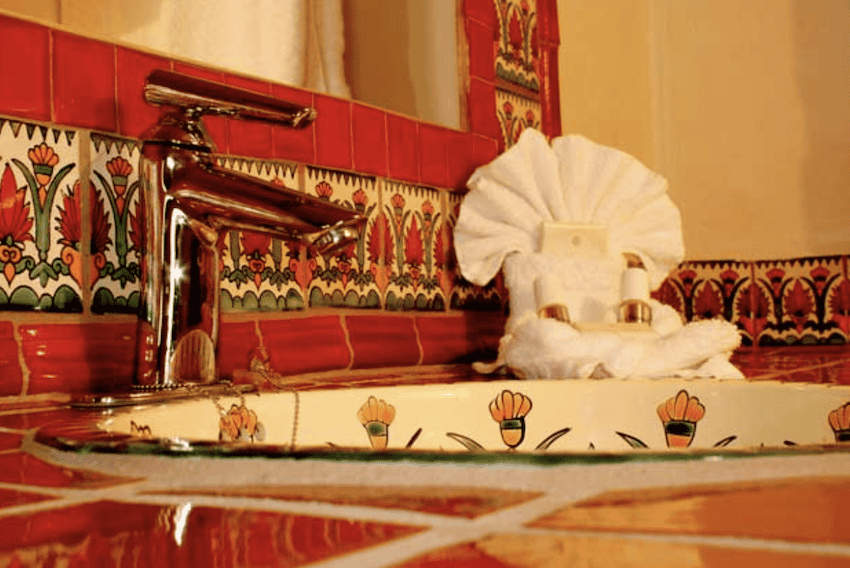

What guests can expect, however, is clean rooms and baths – usually with Mexican-themed decor. There is usually also a central location, air-conditioning, and Wi-Fi service. Swimming pools may be a feature of some properties but they’re not standard. Nor are beachfront vantages and ocean views. Some have attached restaurants and bars, although charges for eating or drinking at these establishments won’t be included in room rates. Siesta Suites, for example, hosts a terrace bar (called The Terrace Bar) and a popular Italian restaurant, Salvatore G’s, in its courtyard area.

What to Know Before Booking

If you want the best rates, book directly through the hotel. Yes, it’s fun to shop for the cheapest available rooms on third-party booking websites but these sites tack on commission charges so that they too can profit. And they often don’t show all relevant taxes and fees. As a local hotel owner noted, the real price invariably isn’t lower than the one the hotels themselves can and do provide.

All of the lodgings mentioned in this article have websites to facilitate reservations. All, too, have a cadre of loyal guests that return regularly. These aren’t corporate operations. They’re privately owned – by couples and families mostly – and it’s in their best interest to ensure guest expectations regarding price and the quality of accommodations are met. That’s what keeps people coming back.

Dealing directly with the hotel also makes it easier to get answers to any questions about dates, rooms, potential discounts, or additional fees (if taxes aren’t already included in the posted room rates).

Why Cheap Hotels Are Better Than Cheap Vacation Rentals

Airbnb rentals have expanded the inventory of affordable properties for those who are attracted to Los Cabos and want to visit but are constrained by budgetary factors. However, there is a dark side. In Los Cabos, as in many popular vacation destinations, what has been termed the “Airbnb effect” has resulted in artificially inflated rent prices for locals, and dwindling inventory due to the decision of landlords to prioritize these rooms for tourist traffic. That means many hospitality workers and colorful characters who make vacations so memorable for visitors are being squeezed out and forced to move.

There may eventually be stricter regulations like the ones recently passed in Mexico City that require property owners to report occupation numbers and pay the resulting taxes, perhaps ameliorating issues for locals. But in the meantime, enjoying comparably low-priced accommodations at Los Cabos hotels is the most sustainable tourism option, with much better service and amenities than are common to all but the most luxurious vacation rentals. And just to be clear: those aren’t cheap.

Chris Sands is the Cabo San Lucas local expert for the USA Today travel website 10 Best, writer of Fodor’s Los Cabos travel guidebook, and a contributor to numerous websites and publications, including Tasting Table, Marriott Bonvoy Traveler, Forbes Travel Guide, Porthole Cruise, Cabo Living and Mexico News Daily. His specialty is travel-related content and lifestyle features focused on food, wine and golf.