Haciendas, whether in ruins or restored, inevitably have fascinating stories to tell, but many of them are hidden away, sometimes in the most unexpected places.

How do you find them? And once you have located one, how do you get inside?

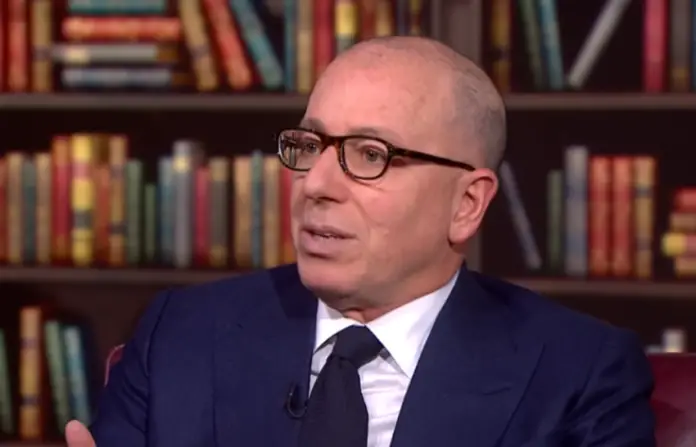

To answer these questions I sat down with Jim Cook, co-author of the blog “Jim and Carole’s Mexican Adventure” and long-time leader of a group of explorers unofficially known as the Hacienda Hunters, based in the Lake Chapala area but ready to track down haciendas wherever they may be found.

Like many foreigners living around Lake Chapala, Cook and his wife Carole started exploring the area guided by Tony Burton’s book “Western Mexico: a Traveler’s Treasury.” Here are some of the recommendations.

Use my bathroom

One of the sites recommended by Burton is the plaza of San Isidro Mazatepec, located 45 kilometers northwest of Chapala, where visitors can see the entrance to the well-preserved casa grande (main house) of what was once a hacienda.

“We were in the plaza,” Cook told me, “and one party member needed to find a restroom. So she went to a peanut seller in the plaza and asked if any public restrooms were nearby. Then a young man buying peanuts said, ‘Why don’t you come with me? You can use the bathroom in my house,’ and he pointed to the casa grande. and she said, ‘No, I can’t do that because I’ve got my friends with me here.’ And the young man replied, ‘Bring them all along!’”

Guests of honor

Cook and friends trooped up to the beautifully preserved casa grande and minutes later sat in the courtyard sipping wine, with the young man translating between them and his mother.

“There we were,” said Cook, “when all of a sudden the big door swings open and a whole mob of relatives visiting from Houston come in… and now we’re in the middle of a big family reunion party with us as the guests of honor!”

When Cook and friends tried to leave, the mother said, “You’ve got to come back and stay with us a while. We have all kinds of bedrooms here.”

This, says Cook, “was my first introduction to that famous Mexicanism: mi casa es su casa and things have gone pretty much the same way on all the hacienda hunts we have been on since.”

How to spot a hacienda

After this experience, the group began looking for more haciendas.

“There is surprisingly little information out there,” said Cook, “but I eventually understood that almost every little pueblo you find was—in the past— a hacienda. Of course, they were broken up after the Revolution when the land was redistributed. So the casa grande and the subsidiary buildings are now repurposed. The chapel, for example, maybe the community church and the casa grande may now be City Hall or a community center. So when you understand this, you can easily spot them. Another thing you can keep an eye out for is a double row of palm trees in a straight line. They will mark the main drive to the former hacienda.”

Since many of these pueblos are at the end of rough brechas (dirt roads), Cook started looking for people with four-wheel-drive, high-clearance vehicles to recruit as Hacienda Hunters.

“After a while,” he told me, “I had a group of people who were hacienda addicts, just as I was. We usually had three drivers of four-wheel drive vehicles, each with three passengers. I learned after a while that a caravan of more than three vehicles is too complicated. and with more than four people in a car for an all-day adventure, it gets a little tight.”

Once an expedition is lined up, Cook looks for information on the hacienda they want to visit.

“Sometimes there’s a lot and sometimes there’s nothing at all. Once or twice I’ve run into haciendas whose names I never found out. Hacienda hunting requires a lot of research.”

Getting inside

Getting inside the hacienda is usually easy if the owner is there, Cook told me. “Virtually all of them are very proud of their hacienda and they know something of its history. so they immediately invite us in and take us around. If there’s only a caretaker present, it’s a little trickier because the caretaker is there to stop you. But even the caretakers will sometimes say, ‘These people look all right, so I’ll just let them walk around.’”

Jim and Carole’s Mexican Adventure – which has had more than one million page views from people living in 130 countries – includes well-researched descriptions and gorgeous photos of 35 haciendas, perhaps enough to turn you, too, into a hacienda addict. Even more dangerous may be the comments in italics sprinkled throughout each blog, relating what you see among the ruins to the bigger picture of Mexico in days gone by.

The Cooks’ description of the Hacienda in Mazatepec, for example, might put you at risk of becoming a historian:

Slavery for all practical purposes

“Under the encomienda system set up by the conquistadors with Crown approval, the indigenous people in an area became, for all practical purposes, the slaves of the hacendados. In theory, this system involved an exchange: protection from hostile tribes by the Spanish owner in return for required labor. Of course, nobody bothered to ask the indigenous people if they agreed to such an exchange. Those who resisted faced extreme punishment including death. By the end of the 17th Century, 500 such ‘protected workers’ labored to produce the wheat that was then the primary product of Hacienda San Isidro Mazatepec.”

And then, there are Cook’s insights. Here’s an example from the blog posting on the Mazatepec Hacienda:

Life in the slow lane

“Oscar seemed to have a special affection for this horse. He spoke quietly as he stroked this beauty. I was curious about Oscar and his family and asked him why they lived in Houston rather than Mexico. ‘It is for the children,’ he answered. ‘Things up north move much more quickly, and that is good for them.’ I considered this for a few moments, then responded. ‘I moved down here for just the opposite reason. Things move much more slowly here, and I like that.'”

Yes, hacienda hunting may be dangerous. It might turn you not only into a historian but also a philosopher.

The writer has lived near Guadalajara, Jalisco, for more than 30 years and is the author of A Guide to West Mexico’s Guachimontones and Surrounding Area and co-author of Outdoors in Western Mexico. More of his writing can be found on his website.